Wrapping Up a Wild Week for the Market

The stock market opened with a strong start on Friday, with the major averages up more than 1 percent following a good day for world markets on Thursday.

The stock market opened with a strong start on Friday, with the major averages up more than 1 percent following a good day for world markets on Thursday.

Bans on “naked short-selling” were put in place in France, Italy, Spain and Belgium on Friday, meaning investors there could not sell securities that lacked the underlying assets with the strategy in mind of buying them back at a lower price. The bans seems to have had a positive impact on those markets.

But at the end of a week of extreme ups and downs, as the mood of investors in the U.S. has swung alternately between pessimism about the continuing financial crisis and positive news about the job market and world stock markets, the S&P 500 still came out early Friday down by about 2 percent for the week. –BF

Your support matters…The New York Times:

American stock markets have been wildly volatile in the past four trading sessions, with alternating days of collapsing and then sharply rising prices. The mood has swung between speculation about worries over the economy and a renewed financial crisis, and confidence that banks are healthy and corporate profits strong.

As the week drew to a close, investors sifted through new data on the economy, including insights into consumer behavior, a crucial element in trying to gauge the pace of the recovery.

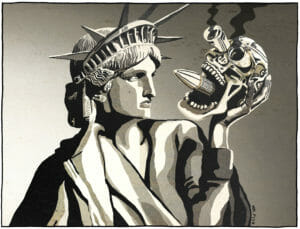

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.