Wall Street’s Not-So-Little Secret

In 2008, the 10 biggest US banks and brokerage firms took $829 billion in emergency loans from the U Treasury and the Federal Reserve Until now, who got what had been a secret (more).

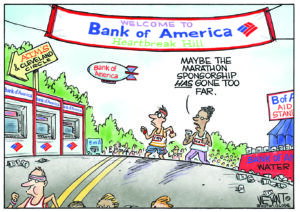

In 2008, the 10 biggest U.S. banks and brokerage firms took $829 billion in emergency loans from the U.S. Treasury and the Federal Reserve. Who got what had been a secret, but thanks to months of litigation, an act of Congress and the work of numerous reporters, we now know.

Morgan Stanley, the largest borrower, received as much as $107.3 billion, while Citigroup took $99.5 billion and Bank of America $91.4 billion. Even foreign companies borrowed large. Almost half of the Fed’s top 30 borrowers were European firms. The Edinburgh-based Royal Bank of Scotland took $84.5 billion — more than any other non-U.S. lender. Germany’s Hypo Real Estate Holding AG took $28.7 billion, which Bloomberg calculated as about $21 million for each of its 1,366 employees.

Some of the loans were very cheap. On Oct. 20, 2008, the U.S. central bank agreed to set a below-market interest rate of 1.1 percent on $113.3 billion worth of month-long loans. Banks were lending to each other at 3.8 percent that same day, which means they were profiting off emergency government relief in the middle of the financial crisis. –ARK

Your support matters…Bloomberg:

While the Fed’s last-resort lending programs generally charge above-market interest rates to deter routine borrowing, that practice sometimes flipped during the crisis. On Oct. 20, 2008, for example, the central bank agreed to make $113.3 billion of 28-day loans through its Term Auction Facility at a rate of 1.1 percent, according to a press release at the time.

The rate was less than a third of the 3.8 percent that banks were charging each other to make one-month loans on that day. Bank of America and Wachovia Corp. each got $15 billion of the 1.1 percent TAF loans, followed by Royal Bank of Scotland’s RBS Citizens NA unit with $10 billion, Fed data show.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.