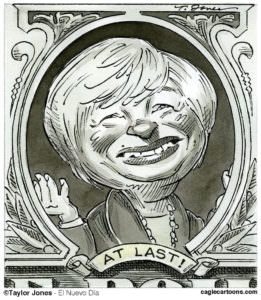

Wall Street Doesn’t Like What Fed Chairman Has to Say

The Federal Reserve will continue to buy bonds at a rate of $85 billion a month, but Chairman Ben Bernanke said better economic indicators mean the central bank could end its quantitative easing policy in 2014.

The Federal Reserve will continue to buy bonds at a rate of $85 billion a month, but Chairman Ben Bernanke said better economic indicators mean the central bank could end its quantitative easing policy in 2014.

Even though the monetary policy will continue for the foreseeable future, the prospect of less action by the Fed shaved 206 points off the Dow by the market’s close.

Bernanke sees the housing market in rebound, and he predicts unemployment will continue to drop, but the Fed has taken a consistently more optimistic view of economic growth, and the economy continues to disappoint.

Although we’re a long way from 2008, income inequality and a lack of quality jobs suggest a disconnect between the high price of stocks on the exchanges and what might be called the “real” economy. Clearly the Fed’s policy thus far has had a bigger impact on the value of shares than the meager economic growth of the nation as a whole.

The Bureau of Economic Analysis puts first quarter growth in 2013 at 2.3 percent, which is not very encouraging considering inflation and population growth.

— Posted by Peter Z. Scheer.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.