Top WaMu Leaders Escape Serious Punishment

The FDIC has reached a deal with three of the executives who presided over Washington Mutual's collapse. The $64.7 million settlement amounts to substantially less than the chief executive alone was paid in the years before his bank set a record for failure.

The FDIC has reached a deal with three of the executives who presided over Washington Mutual’s collapse. The $64.7 million settlement amounts to substantially less than the chief executive alone was paid in the years before his bank set a record for failure.

Gretchen Morgenson of The New York Times is not pleased:

Your support matters…The deal, agreed to by the Federal Deposit Insurance Corporation, requires that the men, among them Kerry Killinger, WaMu’s former chief executive, forgo claims for insurance coverage and some past compensation that they had requested from the bankruptcy court.

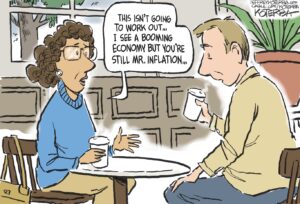

To anyone familiar with WaMu’s Wild West lending practices — “The Power of Yes” was the bank’s motto — the agreement might seem like yet another example of the minimalist punishment meted out to major players in the credit boom and bust.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.