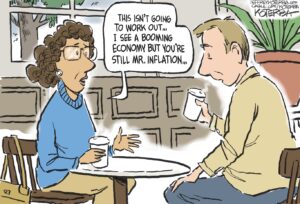

Why Aren’t Rural Americans Included in Inflation Figures?

The cost of living might be rising faster for them. Barn / Gary Stockbridge

Barn / Gary Stockbridge

When the Federal Reserve convenes at the end of January 2023 to set interest rates, it will be guided by one key bit of data: the U.S. inflation rate. The problem is, that stat ignores a sizable chunk of the country—rural America.

Currently sitting at 6.5%, the rate of inflation is still high, even though it has fallen back slightly from the end of 2022.

The overall inflation rate, along with core inflation—which strips out highly volatile food and energy costs—is seen as key to knowing whether the economy is heating up too fast, and guided the Fed as it imposed several large 0.75 percentage point interest rate increases in 2022. The hope is that raising the benchmark rate, which in turn increases the costs of taking out a bank loan or mortgage, for example, will help reduce inflation back to the Fed target of around 2%.

But the main indicator of inflation, the consumer price index, is compiled by looking at the changes in price specifically urban Americans pay for a set basket of goods. Those living in rural America are not surveyed.

As economists who study rural America, we believe this poses a problem: People living outside America’s cities represent 14% of the U.S. population, or around 46 million people. They are likely to face different financial pressures and have different consumption habits than urbanites.

The fact that the Bureau of Labor Statistics surveys only urban populations for the consumer price index makes assessing rural inflation much more difficult—it may even be masking a rural-urban inflation gap.

To assess if such a gap exists, one needs to turn to other pricing data and qualitative analyses to build a picture of price growth in nonurban areas. We did this by focusing on four critical goods and services in which rural and urban price effects may be significantly different. What we found was rural areas may indeed be suffering more from inflation than urban areas, creating an underappreciated gap.

1. The cost of running a car in the country

Higher costs related to cars and gas can contribute to a urban-rural inflation gap, severely eating into any discretionary income for families outside urban areas, a 2022 report found.

This is likely related to there being considerable differences in vehicle purchases, ownership and lengths of commutes between urban and rural Americans.

Car ownership is integral to rural life, essential for getting from place to place, whereas urban residents can more easily choose cheaper options like public transit, walking or bicycling. This has several implications for expenses in rural areas.

Rural residents spend more on car purchases out of necessity. They are also more likely to own a used car. During the first year of the COVID-19 pandemic, there was a huge increase in used car prices as a result of a lack of new vehicles due to supply chain constraints. These price increases likely affected remote areas disproportionately.

Rural Americans tend to drive farther as part of their day-to-day activities. Because of greater levels of isolation, rural workers are often required to make longer commutes and drive farther for child care, with the proportion of those traveling 50 miles (80 kilometers) or more for work having increased over the past few years. In upper Midwest states as of 2018, nearly 25% of workers in the most remote rural counties commute 50 miles (80 kilometers) or more, compared with just over 10% or workers in urban counties.

Longer journeys mean cars and trucks will wear out more quickly. As a result, rural residents have to devote more money to repairing and replacing cars and trucks – so any jump in automotive inflation will hit them harder.

Though fuel costs can be volatile, periods of high energy prices—such as the one the U.S. experienced through much of 2022 – are likely to disproportionately affect rural residents given the necessity and greater distances of driving. Anecdotal evidence also suggests gas prices can be higher in rural communities than in urban areas.

2. Rising cost of eating at home—and traveling for groceries

As eating away from home becomes more expensive, many households may choose to eat in more often to cut costs. But rural residents already spend a larger amount on eating at home – likely due in part to the slimmer choices available for eating out.

This means they have less flexibility as food costs rise, particularly when it comes to essential grocery items for home preparation. And with the annual inflation of the price of groceries outpacing the cost eating out – 11.8% versus 8.3% – dining at home becomes comparably more expensive.

Rural Americans also do more driving to get groceries—the median rural household travels 3.11 miles (5 kilometers) to go to the nearest grocery store, compared with 0.69 miles (1.1 kilometers) for city dwellers. This creates higher costs to feed a rural family and again more vehicle depreciation.

Rural grocery stores are also dwindling in number, with dollar stores taking their place. As a result, fresh food in particular can be scarce and expensive, which leads to a more limited and unhealthy diet. And with food-at-home prices rising faster than prices at restaurants, the tendency of rural residents to eat more at home will see their costs rising faster.

3. The cost of growing old and ill outside cities

Demographically, rural counties trend older – part of the effect of younger residents migrating to cities and college towns for either work or educational reasons. And older people spend more on health insurance and medical services. Medical services overall have been rising in cost too, so those older populations will be spending more for vital doctors visits.

Again with health, any increase in gas prices will disproportionately hit rural communities more because of the extra travel needed to get even primary care. On average, rural Americans travel 5 more miles (8 kilometers) to get to the nearest hospital than those living in cities. And specialists may be hundreds of miles away.

4. Cheaper home costs, but heating and cooling can be expensive

Rural Americans aren’t always the losers when it comes to the inflation gap. One item in rural areas that favors them is housing.

Outside cities, housing costs are generally lower, because of more limited demand. More rural Americans own their homes than city dwellers. Since owning a home is generally cheaper than renting during a time of rising housing costs, this helps insulate homeowners from inflation, especially as housing prices soared in 2021.

But even renters in rural America spend proportionately less. With housing making up around a third of the consumer price index, these cost advantages work in favor of rural residents.

However, poorer-quality housing leaves rural homeowners and renters vulnerable to rising heating and cooling costs, as well as additional maintenance costs.

Inflation—a disproportionate burden

While there is no conclusive official quantitative data that shows an urban-rural inflation gap, a review of rural life and consumption habits suggests that rural Americans suffer more as the cost of living goes up.

Indeed, rural inflation may be more pernicious than urban inflation, with price increases likely lingering longer than in cities.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.