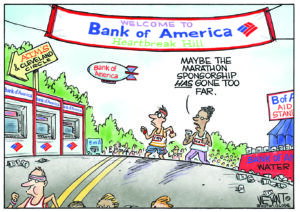

Time to Move Your Money

Saturday is the day 80,000 people have pledged to punish "too big to fail" banks by moving their money to credit unions and local community institutions. How does it work? Will banks feel the hurt? How can it be done quickly and conveniently? Josh Harkinson at Mother Jones answers these questions and more.

Saturday is the day 80,000 people have pledged to punish “too big to fail” banks by moving their money to credit unions and local community institutions. How does it work? Will banks feel the hurt? How can it be done quickly and conveniently? Josh Harkinson at Mother Jones answers these questions and more. — ARK

Your support matters…Mother Jones:

Why would I want to move my money out of my existing bank?

You’ll probably save money in the long run. According to a 2009 year study by the Filene Research Institute, the average credit union account holder paid $71.47 in annual fees, compared to $183.14 paid by the typical bank customer. And new restrictions on debit card fees imposed last month by the Dodd-Frank Act have sent banks scrambling for even more ways to nickel and dime their customers in pursuit of profits. Nonprofit credit unions, on the other hand, only need to break even. They also tend to plow their money back into basic loans in their own communities, instead of dabbling in the kind of complex and risky securitized investments that caused large banks to go bust and drag down the economy. It’s important to note that credit unions and small local banks aren’t recession-proof: a striking 17 percent of Florida’s bank failures since 2008 were community banks.

What’s the process?

Don’t expect to be able to open a credit union account and close your old bank account in one day. You’ll need to receive new checks and a debit card in the mail, switch over any automated deposits and electronic bill paying services, and wait for pending financial transactions to clear. Only then should you give your old bank the boot. Here’s a searchable map that locates credit unions near you.

Are big banks freaking out over this?

Most big banks rely on their vast numbers of personal checking and savings accounts to shore up their cash reserves and make lucrative investments. “If everybody moved their money, it would make a huge difference,” Rogers says. Still, the nearly 80,000 people who’ve made online pledges to join Bank Transfer Day probably won’t cause bankers to break a sweat—at least not yet. Add another 400,000 of them, and “you’d get not just frowns, but maybe gasps in the boardroom.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.