The Number of Giant Companies Paying $0 in Corporate Taxes Doubles

Sixty profitable Fortune 500 companies have managed to avoid paying taxes. Jeff Bezos, CEO and founder of Amazon. (Reed Saxon / AP)

Jeff Bezos, CEO and founder of Amazon. (Reed Saxon / AP)

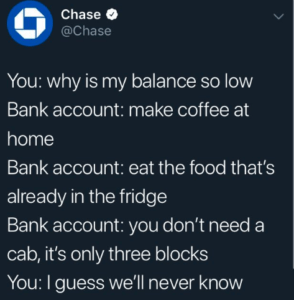

JPMorgan Chase’s attempt at Twitter humor failed Monday morning.

What may have seemed like a lighthearted (and since-deleted) joke about its followers’ excessive spending habits was met with a stream of replies pointing out that perhaps a bank that received $12 billion in bailout money after the financial crisis, whose CEO’s salary is $31 million, and that has a history of mortgage fraud, should refrain from publicly lecturing its customers on their spending habits for coffee and lunch.

The reaction to the tweet is reflective of a political climate in which many Americans are concerned about economic inequality and particularly whether corporations are paying their fair share in taxes. Amazon paid no federal taxes in 2018. Neither did Delta Air Lines, Chevron or General Motors. Meanwhile, Amazon CEO Jeff Bezos’s net worth is $150 billion.

That’s a far cry from the $18,000-a-year salary of Colin Roberson of Akron, Ohio. Roberson, who cleans carpets for a living, compared his financial situation to Bezos’s, telling Stephanie Saul and Patricia Cohen of The New York Times that “[Bezos] could be taxed at 99.9 percent and still have millions left over. … I’d be homeless.”

The phenomenon of giant corporations getting tax breaks isn’t new. As Saul and Cohen report, “For decades, profitable companies have been able to avoid corporate taxes.” What has changed is the increase in companies able to do so. “The list of those paying zero roughly doubled last year,” Saul and Cohen continued, “as a result of provisions in President Trump’s 2017 tax bill that expanded corporate tax breaks and reduced the tax rate on corporate income.”

An April report from the Institute on Taxation and Economic Policy (ITEP) reveals how 60 profitable Fortune 500 companies managed to avoid paying taxes. As the report explains:

In 2018, 60 of America’s biggest corporations zeroed out their federal income taxes on $79 billion in U.S. pretax income. Instead of paying $16.4 billion in taxes at the 21 percent statutory corporate tax rate, these companies enjoyed a net corporate tax rebate of $4.3 billion.

“It’s a topic,” Saul and Cohen write, “that several presidential candidates, led by Senators Bernie Sanders and Elizabeth Warren, have hammered recently as they travel the campaign trail.”

During a Fox News Town Hall last week, Sanders told the crowd that “Amazon, Netflix and dozens of major corporations, as a result of Trump’s tax bill, pay nothing in federal taxes. … I think that’s a disgrace.” Under Warren’s tax plan, which would have companies pay a new 7% tax on every dollar in profits over $100, Amazon would have paid $698 million in corporate taxes in 2018.

Former Vice President Joe Biden appears to be playing both sides when it comes to raising corporate taxes and discussing economic inequality. Last week, in a speech to the Brookings Institution he said, “I don’t think 500 billionaires are the reason we’re in trouble. The folks at the top aren’t bad guys.” This was a departure from a previous Brookings speech last year, when he spoke much more forcefully in favor of a more equitable tax code: “We have to deal with this tax code. … It’s wildly skewed toward taking care of those at the very top. It overwhelmingly favors investors over workers.”

While taxes are in general a more important issue for Republicans than Democrats, according to fall 2018 Gallup poll, when surveys ask specifically about raising taxes on corporations, “More Americans support raising the corporate tax rate than lowering it or leaving it unchanged,” as Saul and Cohen report.

Read the full ITEP report here.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.