The Man Most Responsible for the Monopolization of America

As the United States moves against Google, antitrust law is still under the influence of Robert Bork. Robert Bork's influence lives on in the current monopolization of American corporations. (AP Photo/Ira Schwarz)

Robert Bork's influence lives on in the current monopolization of American corporations. (AP Photo/Ira Schwarz)

One of the most important initiatives of the Biden administration is its attack on corporate monopolies.

Today, the Justice Department’s case against Google goes to trial. The Department alleges that Google illegally abused its power over online search to throttle competition. It is the government’s first monopoly trial of the modern internet era.

Later this month, the Federal Trade Commission (FTC) will file its lawsuit against Amazon, alleging that Amazon favors its own products over competitors’ on its platforms and uses predatory tactics with outside sellers on Amazon.com.

Whether it’s Ticketmaster and Live Nation consolidating control over live performances, Kroger and Albertsons dominating the grocery market, or Amazon and Google scooping up every operation in sight, corporate concentration is on the rise.

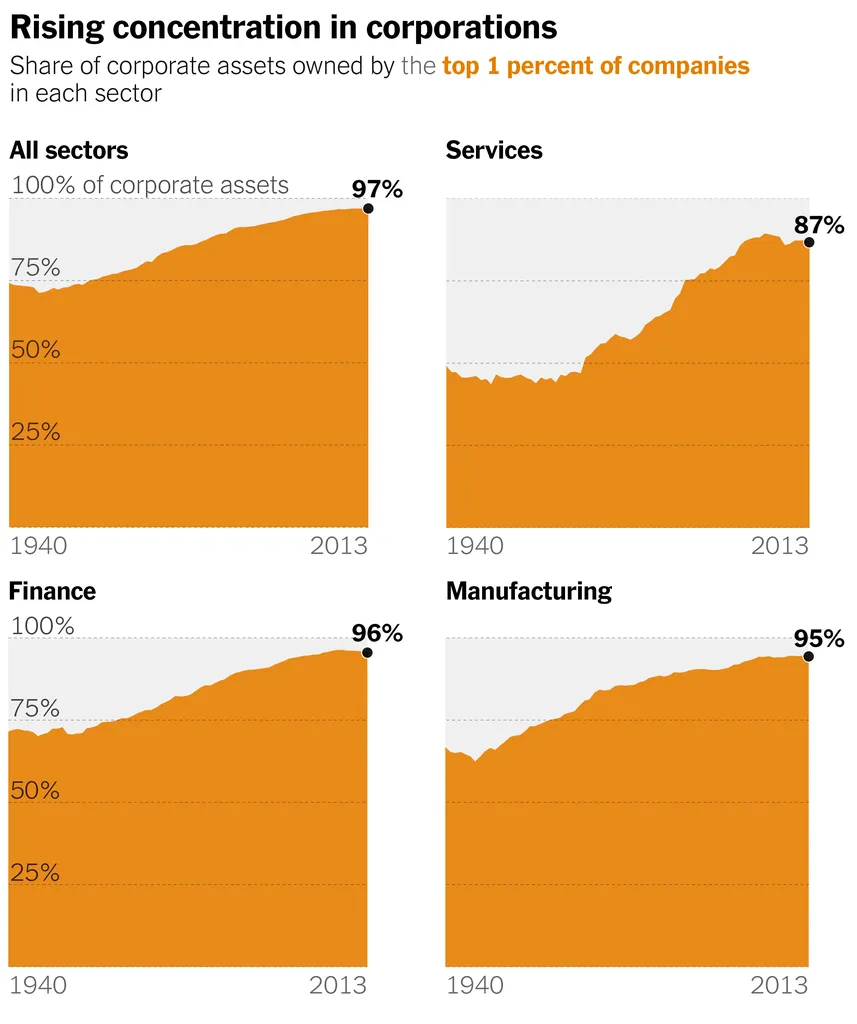

Over the past several decades, giant corporations have come to dominate most American industries, as this chart shows:

The social costs of corporate concentration are growing.

- The typical American household is paying more than $5,000 a year because corporations can raise their prices without fear that competitors will draw away consumers.

- Such corporate market power has also been a major force driving inflation.

- Huge corporations also suppress wages, because workers have fewer employers from whom to get better jobs.

- And corporate giants are also fueling massive flows of big money into politics (one of the major advantages of large size).

Yet the federal courts have been reluctant to do anything about this and are pushing back against the Biden administration’s efforts. Why? Because of a man named Robert Bork.

Let me explain.

I first met Bork in September 1971, when I took his class on antitrust at Yale Law School. I recall him as a large, imposing man, with a red beard and a perpetual scowl.

He was only in his mid-40s then, but he seemed impatient and bored with us (also in that class were Hillary Rodham and Bill Clinton).

We kept challenging his view that the only legitimate purpose of antitrust law was to lower consumer prices.

“What about the political power of giant corporations?” we asked.

His retort: “How do you expect courts to measure political power?”

“But what about the power of big corporations to suppress wages?”

“Employees are always free to find better jobs.”

“What about their power to undercut potential rivals with lower prices?”

“Lower prices are good for consumers.”

“What about the sheer power that comes from their gigantic size?”

“Also good for consumers. Large size means lower costs through efficiencies of scale.”

Bork had an answer to each of our objections, but we were never satisfied. He spouted economic theory based on dubious “Chicago School” assumptions that all economic players have perfect information and face no cost of entering or leaving markets (Bork had attended the University of Chicago and its law school).

Even in our mid-20s, we knew this was bullshit.

Bork refused to recognize power — even though antitrust laws emerged from the Gilded Age of the late 19th century, when a central concern was the untrammeled power of giant corporations.

A few years later, Bork wrote a book called The Antitrust Paradox that summarized his ideas. The staff of a conservative California governor bound for the White House read it and passed it along to their boss, and Bork’s book formed a basic tenet of Reaganomics.

Federal judges read it, too. Most judges didn’t (and still don’t) know much economics and hated getting bogged down in interminable and almost incomprehensible antitrust trials that could last for years. They found Bork’s simplicity and cogency helpful in limiting such lawsuits.

Over the past several decades, giant corporations have come to dominate most American industries.

Bork’s influence over the courts represented the culmination of years of work by the monied interests to kill off antitrust law. They’re still at it.

Which is why the new view of antitrust now being pioneered by the Biden administration through the FTC and the Antitrust Division of the Justice Department is so important.

This new view regards corporate concentration as a problem even if it provides economies of scale that might allow lower consumer prices in the short term. That’s because corporate concentration also means less innovation, more wage suppression, predatory behavior, price-push inflation, and increased political power.

Besides their lawsuits against Google and Amazon, the FTC and the Justice Department have proposed new merger guidelines to keep monopolies in check. Not surprisingly, giant corporations are doing whatever they can to stop these new protections from taking effect.

The optimist in me thinks that as the public becomes more aware of the close connections among corporate power, predation, inflation, wage suppression, and political corruption, the new antitrust movement will eventually succeed.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.