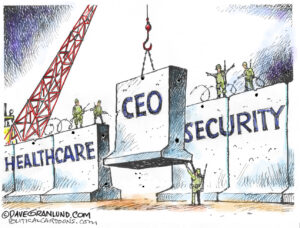

Report: ‘Fast Food CEOs Rake In Taxpayer-Subsidized Pay’

While fast food workers stage a one-day strike, a report from the Global Economy Project shows how the industry's CEOs have subsidized their own multimillion dollar salaries with taxpayer funds in addition to saving money by paying employees low wages. Report author Sarah Anderson explains.

While fast food workers stage a one-day strike, a report from the Global Economy Project shows how the industry’s CEOs have subsidized their own multimillion dollar salaries with taxpayer funds in addition to saving money by paying employees low wages. Report author Sarah Anderson explains.

Anderson, who is director of the Global Economy Project at the Institute for Policy Studies, told “Democracy Now!” on Thursday of the finding, “this is a perverse loophole in our tax code that essentially means that the more corporations pay their CEO, the less they pay in taxes. And that’s because there is this loophole that allows companies to deduct unlimited amounts from their corporate income taxes for the expense of executive pay, as long as it’s so-called performance pay—so, stock options and other bonuses that are configured in a way to qualify for this tax loophole. And what it means essentially is that ordinary taxpayers are subsidizing excessive CEO pay.”

— Posted by Alexander Reed Kelly.

‘Democracy Now!’:

Dig, Root, GrowThis year, we’re all on shaky ground, and the need for independent journalism has never been greater. A new administration is openly attacking free press — and the stakes couldn’t be higher.

Your support is more than a donation. It helps us dig deeper into hidden truths, root out corruption and misinformation, and grow an informed, resilient community.

Independent journalism like Truthdig doesn't just report the news — it helps cultivate a better future.

Your tax-deductible gift powers fearless reporting and uncompromising analysis. Together, we can protect democracy and expose the stories that must be told.

This spring, stand with our journalists.

Dig. Root. Grow. Cultivate a better future.

Donate today.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.