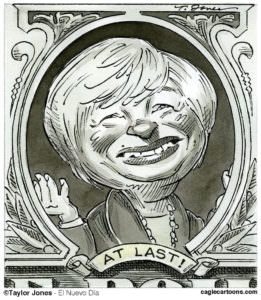

N.Y. Fed Gave Big Banks Secret Emergency Loans in ’08

In a revelation that should surprise no one, lending records of the Federal Reserve Bank of New York released by a March court order show that the Fed made cut-rate emergency loans of up to $30 billion each to major banks in 2008 without informing Congress, shareholders or the American public. (more)

In a revelation that should surprise no one, lending records of the Federal Reserve Bank of New York released by a March court order show that the Fed made cut-rate emergency loans of at least $30 billion each to major banks in 2008 without informing Congress, shareholders or the American public.

Why did financial officials keep the loans — which were as low as .01 percent at a time when the Fed regularly charged 0.5 percent — a secret? Because the purchasing public might “inaccurately” lose faith in a bank openly seeking assistance, vice president of the New York Fed’s markets group says, in what looks to be a brazen act of Orwellian doublethink. –ARK

Dig, Root, GrowBloomberg:

The $80 billion initiative, called single-tranche open-market operations … made 28-day loans from March through December 2008, a period in which confidence in global credit markets collapsed after the Sept. 15 bankruptcy of Lehman Brothers Holdings Inc.

… The Fed opposed disclosing details of its open market operations because doing so would probably cause borrowers “substantial competitive harm,” according to a March 2009 declaration by Christopher R. Burke, vice president of the New York Fed’s markets group. The declaration is filed in federal court.

Revealing the borrowing “could lead market participants to inaccurately speculate that the primary dealer was having difficulty finding term funding against its collateral in the open market and that the dealer itself must therefore be in financial trouble,” Burke said in opposing a media request for records about the borrowing.

This year, we’re all on shaky ground, and the need for independent journalism has never been greater. A new administration is openly attacking free press — and the stakes couldn’t be higher.

Your support is more than a donation. It helps us dig deeper into hidden truths, root out corruption and misinformation, and grow an informed, resilient community.

Independent journalism like Truthdig doesn't just report the news — it helps cultivate a better future.

Your tax-deductible gift powers fearless reporting and uncompromising analysis. Together, we can protect democracy and expose the stories that must be told.

This spring, stand with our journalists.

Dig. Root. Grow. Cultivate a better future.

Donate today.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.