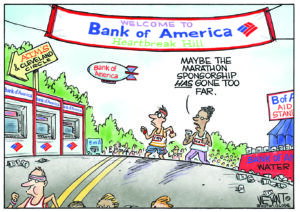

More Than $100 Billion in Subsidies for Too Big to Fail Banks

A Bloomberg Markets magazine study estimates that dirt-cheap borrowing programs and other benefits have saved the nation's six largest banks -- JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley -- $102 billion since 2009.

A Bloomberg Markets magazine study estimates that dirt-cheap borrowing programs and other benefits have saved the nation’s six largest banks — JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley — $102 billion since 2009.

— Posted by Alexander Reed Kelly.

Your support matters…The Huffington Post:

Ending the subsidy and the possibility that taxpayers will have to bail out a big, failing bank is the aim of the bill introduced last month by Sens. Sherrod Brown (D-Ohio) and David Vitter (R-La.). That measure would force the biggest banks to hold more capital.

Mortified, the big banks have joined forces and hired some political helpers, including Republican Tony Fratto and Democrat Stephanie Cutter, to push back against the momentum for breaking them up, the Wall Street Journal wrote earlier this week.

Hilariously, big bank officials briefly considered pushing smaller community banks — which don’t enjoy the subsidy that the big banks get and are thus at a competitive disadvantage — to help them with the pushback, the WSJ reported. Wisely, they dropped the idea.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.