Many Reasons to March Against Tax Injustice

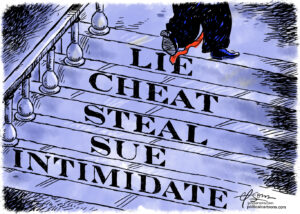

There are two Americas: one that pays taxes for the public good and one that works hard to pay as little tax as possible It's clear which one President Trump serves There are two Americas: one that pays taxes for the public good and one that works hard to pay as little tax as possible. Dressed as the "Real Chicken Don," Shawn Frye takes part in a Sacramento demonstration on Wednesday to call for President Trump to release his tax returns. (Rich Pedroncelli / AP)

1

2

Dressed as the "Real Chicken Don," Shawn Frye takes part in a Sacramento demonstration on Wednesday to call for President Trump to release his tax returns. (Rich Pedroncelli / AP)

1

2

Dressed as the “Real Chicken Don,” Shawn Frye takes part in a Sacramento demonstration on Wednesday to call for President Trump to release his tax returns. (Rich Pedroncelli / AP)

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.