Josh Hawley and the Mirage of Republican ‘Populism’

The proposed House budget bill should put to rest any talk about a Republican turn toward the interests and concerns of ordinary people. Sen. Josh Hawley, R-Mo. (AP Photo/Jose Luis Magana)

Sen. Josh Hawley, R-Mo. (AP Photo/Jose Luis Magana)

Last Thursday, Sen. Josh Hawley of Missouri rebuked “corporatist Republicans” in a New York Times op-ed published shortly after his colleagues in the House released a draft of their “big, beautiful” reconciliation bill. The senator specifically called out those in his own party who are pushing for big cuts to Medicaid in order to extend the tax cuts that Donald Trump signed into law in 2017. Cutting the insurance program that currently serves over 70 million Americans in order to fund “corporate giveaways” and tax cuts for the rich, wrote the senior senator from Missouri, is both “morally wrong and politically suicidal.”

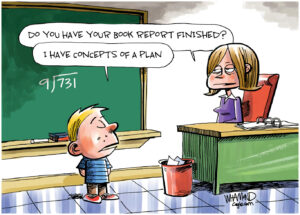

It is also, Hawley argued, out of step with the party’s current political and ideological trajectory. In his telling, these “corporatist” Republicans represent a dying breed. The “Wall Street wing” of the GOP is a “noisy contingent” that wants to revive the “old-time religion” of corporate Republicanism, but these efforts are destined to fail, as the GOP is now the “party of the working class.”

If Hawley’s argument sounds familiar, it borrows from a well-worn script. For years, the mainstream media has lent credibility to the self-serving tale of a new-look GOP that has reinvented itself as the “party of the people” and adopted policies favoring workers over big donors. For obvious reasons, Republicans have been eager to rebrand themselves as the populist party of the working class and their opponents as out-of-touch elites. It is much less obvious why the mainstream press has been so willing to play along every step of the way, credulously repeating GOP talking points and exaggerating the influence of “populists” inside the party.

Republicans have been eager to rebrand themselves as the populist party of the working class.

Indeed, nothing demonstrates the grip that the “old-time religion” still has on the party under Trump better than the reconciliation bill just released by House Republicans.

If passed in its current form, the budget bill would slash around $715 billion in funding for Medicaid and the Affordable Care Act and enact burdensome work requirements for recipients. That would lead to a massive reduction in the rolls over the next decade, with millions of Americans becoming uninsured as a result. In addition to these cuts, House Republicans have also proposed $300 billion in reductions to the Supplemental Nutrition Assistance Program, which helps put food on the table for 41 million Americans. Together, these cuts would devastate poor and working-class communities — all for the purpose of closing a budget shortfall that could easily be avoided by sunsetting the 2017 tax cuts that disproportionately benefit the top 1% and 0.1%.

Conspicuously absent from the proposed reconciliation bill: the supposed tax increases on millionaires that the party’s “populists” — including President Donald Trump — had claimed to be pushing for.

For weeks leading up to the unveiling of the House Republican tax plan, Republican insiders seeded numerous stories to the press about the growing effort inside the party — apparently led by the president — to craft a tax plan that would reflect the GOP’s new identity as a “pro-worker” party. Not only was Trump pushing for a higher marginal rate on millionaires, we were told, but for the elimination of the notorious carried interest loophole that allows private equity managers to pay a lower tax rate than middle-class Americans. Until recently, the party’s populists appeared to have the upper hand — enough so to prompt anti-tax crusader Grover Norquist to complain to the press and warn that even a modest tax hike on millionaires would be “incredibly destructive economically” and “very foolish politically.”

As it turned out, Norquist had nothing to fear. The House GOP not only kept the 2017 tax cuts intact, it sweetened the deal with more giveaways for the rich. In a public statement shortly after its release, Norquist commended House Republicans for “delivering across-the-board income tax cuts for ALL income groups.” But the vast majority of gains will go to those at the very top, while the working poor will probably see their after-tax income reduced. That’s according to an analysis by the president’s alma mater, Penn Wharton, which found that the extended cuts would deliver an average gain of more than $389,000 in after-tax income for the top 0.1% of earners in 2026. In contrast, Americans who earn less than $51,000 would actually see their after-tax income fall when the various cuts to social programs are factored in. Those making between $17,000 and $51,000 would lose an average of $700 in 2026, while those making under $17,000 could see their income drastically reduced by up to $1,000.

Beyond preserving existing cuts, the House plan includes several additional benefits for the wealthy and well-connected. The 2017 Tax Cuts and Jobs Act temporarily doubled the estate tax exemption from $5.5 million to $11.4 million for individuals and twice that for married couples, adjusted annually for inflation. The House proposal extends and enlarges the exemption to $15 million for single filers and $30 million for couples, delivering yet another windfall to wealthy families. The plan would also expand a deduction for pass-through businesses that have delivered a majority of its savings to those with adjusted gross incomes of more than $500,000. In another predictable victory for Wall Street, House Republicans chose not to repeal the carried interest loophole or increase the 1% tax on stock buybacks that President Joe Biden signed into law in 2022.

What populist breadcrumbs the bill does contain — such as an expansion of the child tax credit — are clearly intended to appease the party’s “pro-worker” wing. Unlike tax cuts for the rich, these measures are written to expire at the end of Trump’s term and are offset by the proposed reductions to Medicaid and other social programs.

The measure would hurt low-income students who rely on financial aid and scholarships the most.

The House Republicans’ one big tax hike, meanwhile, speaks volumes about party priorities. Under the House plan, universities with endowments that exceed $500,000 per student would be on the hook for a major tax increase on endowment income, with the rate going up to as high as 21% for the wealthiest universities. That was an easy call for Republicans who refuse to raise taxes on billionaires or corporations yet want to appear as if they’re challenging “elites.” Here, Republicans can keep taxes low for the 1% while targeting elite universities that promulgate “woke” ideology. In the end, the measure would end up hurting low-income students who rely on financial aid and scholarships the most, while further cutting into research funding. This fits nicely with the Trump administration’s campaign against universities and research institutions, though it hardly attests to the GOP’s putative transformation into a “party of the working class.”

The Republican budget bill is still a long way from becoming law. It faces an uphill battle in the Senate, while divisions have already hampered its journey through the committees. On Friday, several members of the conservative Freedom Caucus held it up in the Budget Committee before relenting on Sunday night after Speaker Mike Johnson, R-La., vowed to make a few alterations. Importantly, those hardliners did not hold the bill up because it was too draconian in its cuts to Medicaid, but because it wasn’t draconian enough. Republicans only seem to take principled stands when it involves making life more difficult for the poor.

Despite the sounds produced by a small contingent of GOP “populists,” it is obvious that the party is not moving toward a working-class conservatism. The old religion prevails.

Dig, Root, GrowThis year, we’re all on shaky ground, and the need for independent journalism has never been greater. A new administration is openly attacking free press — and the stakes couldn’t be higher.

Your support is more than a donation. It helps us dig deeper into hidden truths, root out corruption and misinformation, and grow an informed, resilient community.

Independent journalism like Truthdig doesn't just report the news — it helps cultivate a better future.

Your tax-deductible gift powers fearless reporting and uncompromising analysis. Together, we can protect democracy and expose the stories that must be told.

This spring, stand with our journalists.

Dig. Root. Grow. Cultivate a better future.

Donate today.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.