How Markets Make Fools of Us

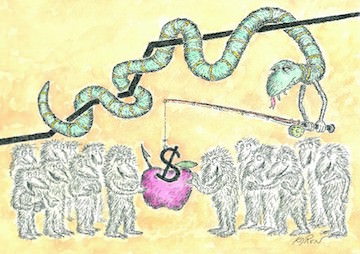

In their new book “Phishing for Phools: The Economics of Manipulation & Deception,” George Akerloff and Robert Shiller merge psychology with economics to give “a broader account of how and why markets produce economic harm." Cover detail of "Phishing for Phools: The Economics of Manipulation & Deception." (Princeton University Press)

Cover detail of "Phishing for Phools: The Economics of Manipulation & Deception." (Princeton University Press)

In their new book “Phishing for Phools: The Economics of Manipulation and Deception,” George Akerloff and Robert Shiller merge psychology with economics to give “a broader account of how and why markets produce economic harm,” writes Harvard Law professor and former Obama administration regulator Cass Sunstein in The New York Review of Books.

Dealing in concepts that have seemed clear to many observers for a long time and which are being articulated for current generations in the field of behavioral economics, Sunstein writes that “Akerloff and Shiller believe that once we understand human psychology, we will be a lot less enthusiastic about free markets and a lot more worried about the harmful effects of competition”:

In their view, companies exploit human weaknesses not necessarily because they are malicious or venal, but because the market makes them do it. Those who fail to exploit people will lose out to those who do. In making that argument, Akerlof and Shiller object that the existing work of behavioral economists and psychologists offers a mere list of human errors, when what is required is a broader account of how and why markets produce systemic harm.

Akerlof and Shiller use the word “phish” to mean a form of angling, by which phishermen (such as banks, drug companies, real estate agents, and cigarette companies) get phools (such as investors, sick people, homeowners, and smokers) to do something that is in the phisherman’s interest, but not in the phools’. There are two kinds of phools: informational and psychological. Informational phools are victimized by factual claims that are intentionally designed to deceive them (“it’s an old house, sure, but it just needs a few easy repairs”). More interesting are psychological phools, led astray either by their emotions (“this investment could make me rich within three months!”) or by cognitive biases (“real estate prices have gone up for the last twenty years, so they’re bound to go up for the next twenty as well”). …

From all of these examples, Akerlof and Shiller offer a general account, which is that phishing occurs because of the “manipulation of focus.” Like magicians and pickpockets, phishermen are able to take advantage of “an errant focus by the phool.” Indeed, the idea that free markets work, and that government is the problem, “is itself a phish for phools,” a kind of story, one that does not capture reality. With respect to Social Security reform, securities regulation, and campaign finance reform, the United States has suffered from false and skewed claims that fail to account for the fact that free markets make people free not only to choose but also “free to phish, and free to be phished. Ignorance of those truths is a recipe for disaster.”

Akerlof and Shiller contend that behavioral economists have failed to explore, or perhaps even to see, the ubiquity of phishing, and the extent to which free markets promote it. Instead of a catalog of human errors and behavioral biases, they seek a more general account, one that gives “a picture to the mental frames that inform people’s decisions.” That picture involves “the stories we are telling ourselves.” Akerlof and Shiller believe that the idea of storytelling is “a new variable” for economics, one that explains why “people make decisions that can be quite far from maximizing their own welfare.” Thus “phishing for phools is not some occasional nuisance. It is all over the place.” Whenever “we have a weakness—if we have a way in which we are phishable—the phishermen will be there in waiting.”

Continue reading here.

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.