GOP Appeases Rubio, Finalizes Tax Bill

House Republicans are expanding the child tax credit to placate Sen. Marco Rubio, who had expressed dissatisfaction with the size of the credit that low-income families can claim.WASHINGTON — Congressional Republicans finalized their sweeping tax package Friday, expanding its child tax credit to placate a reluctant GOP senator as they pushed to muscle the bill through Congress next week and give President Donald Trump his first major legislative victory.

Sen. Marco Rubio of Florida has been a potential holdout, though lawmakers have been working to appease him. Rubio wrote on Twitter earlier Friday that he was dissatisfied with the size of a tax credit that low-income families can claim for their children.

“The #workingclass is always forgotten in D.C. We need to add more #taxcuts for #workingclass parents especially those earning 20k- 50K,” Rubio wrote.

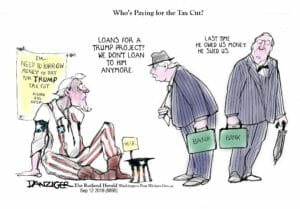

At the White House, Trump said he was confident that Congress would pass the legislation. The package would give generous tax cuts to corporations and the wealthiest Americans — Trump among them — and more modest tax cuts to low- and middle-income families.

“We’re putting in a tremendous child tax credit and it is increasing on a daily basis,” Trump said. “I think that we are going to be in a position to pass something as early as next week which will be monumental.”

Members of a House-Senate conference committee were signing the final version of the legislation Friday. They have been working to blend different versions passed by the House and Senate.

Two Republican members of the committee, Reps. Devin Nunes of California and Kristi Noem of South Dakota, said they believed Rubio’s concerns had been met, but Rubio’s office could not confirm it.

The tax package would double the basic per-child tax credit from $1,000 to $2,000. The bill makes a smaller amount available to families even if they owe no income tax. Noem said Friday the amount has been increased from $1,100 to $1,400.

Rubio has said he wanted the $1,100 figure increased, but he hasn’t said by how much.

Low-income taxpayers would receive the money in the form of a tax refund, which is why it’s called a “refundable” tax credit.

Rubio’s potential defection had pushed the Republicans’ razor-thin majority in the Senate closer to the edge.

Senate Republicans could still pass the package without Rubio’s vote, but they would be cutting it extremely close. An original version was approved 51-49 — with Rubio’s support.

The Senate turmoil erupted after a key faction of House Republicans came out in favor of the bill, boosting its chances. Members of the conservative House Freedom Caucus predicted the vast majority of their members would support the package.

The up-and-down turns came after House and Senate Republican leaders forged an agreement in principle on the most sweeping overhaul of the nation’s tax laws in more than 30 years. Republican leaders predicted swift passage next week, sending the bill to Trump for his signature.

At the White House, Trump said Thursday he was confident that Rubio will get onboard.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.