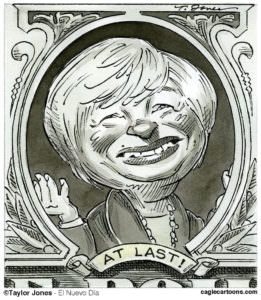

Fed Forecasts Economic Gloom

Federal Reserve Chairman Ben Bernanke expects America's economic struggles to continue well into next year and has asked Congress to expand his regulatory powers. Lawmakers are unlikely to fulfill his request any time soon. Bernanke also suggested that the Fed could continue to bail out investment banks.

Federal Reserve Chairman Ben Bernanke expects America’s economic struggles to continue well into next year and has asked Congress to expand his regulatory powers. Lawmakers are unlikely to fulfill his request any time soon. Bernanke also suggested that the Fed could continue to bail out investment banks.

Your support matters…New York Times:

Federal policy makers have concluded that the turmoil plaguing the housing and financial markets is likely to spill deep into 2009, becoming one of the most significant domestic problems to confront the next president when he steps into the White House in January.

Ben S. Bernanke, the chairman of the Federal Reserve, publicly indicated on Tuesday that he believes the problems will persist into next year when he outlined a series of steps the Fed is considering in the coming months.

One such step would extend low-interest lending programs to Wall Street’s largest investment banks into next year. The programs, one of which was set to expire in September, can continue only if the Fed issues a finding that there are “unusual and exigent circumstances” that justify them.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.