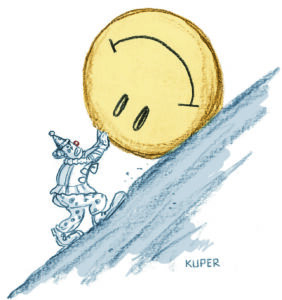

Debt Has Bipartisan Support

There's one thing Democrats and Republicans in Congress agree on these days: When it comes to raising hundreds of billions of dollars to bail out banks or stimulate the economy, better to go further into debt than cut costs or raise taxes.

There’s one thing Democrats and Republicans in Congress agree on these days: When it comes to raising hundreds of billions of dollars to bail out banks or stimulate the economy, better to go further into debt than cut costs or raise taxes.

But even groups such as the Committee for a Responsible Federal Budget agree that might not be such a bad idea.

Here’s hoping China doesn’t ask for its money back.

Dig, Root, GrowNew York Times:

“Right now would not be the time to balance the budget,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a bipartisan Washington group that normally pushes the opposite message.

Confronted with a hugely expensive economic crisis, Democratic and Republican lawmakers alike have elected to pay the bill mainly by borrowing money rather than cutting spending or raising taxes. But while the borrowing is relatively inexpensive for the government in a weak economy, the cost will become a bigger burden as growth returns and interest rates rise.

This year, we’re all on shaky ground, and the need for independent journalism has never been greater. A new administration is openly attacking free press — and the stakes couldn’t be higher.

Your support is more than a donation. It helps us dig deeper into hidden truths, root out corruption and misinformation, and grow an informed, resilient community.

Independent journalism like Truthdig doesn't just report the news — it helps cultivate a better future.

Your tax-deductible gift powers fearless reporting and uncompromising analysis. Together, we can protect democracy and expose the stories that must be told.

Dig. Root. Grow. Cultivate a better future.

Donate today.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.