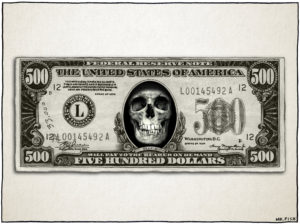

Beware Wall Street’s Rent-to-Own Scam

The newest thing in housing looks like a great deal for would-be home buyers, but a closer look reveals a thorny trap.

The newest thing in housing looks like a great deal for would-be home buyers, but a closer look reveals a thorny trap.

This version of rent-to-own is called “lease purchase,” and the basic idea is that you can rent a house and one day buy it.

But as ProPublica’s Jesse Eisinger notes, the deal transfers to the renter some costs traditionally paid by the owner, and it’s easier to evict a renter than it is a buyer:

Having pride in ownership means that the renter takes care of the property more carefully. So that’s a good thing — for the owner, that is.

[Eli Shaashua, of Red Granite Capital Partners] went on to explain that his options last generally for two years. A renter pays a bit extra for the right to buy the house at a predetermined price, one above the current value.

Then Shaashua delivered the kicker to the roomful of would-be investment managers: “Most times, given the reality, tenants do take it, but it’s hard for them to execute the option,” he said. “Our experience is that most stay until the end and then they say they cannot come up with the down payment or decide not to stay in the property.”

Voila, free money. This amounts to an admission that the product exploits consumers’ lack of financial savvy. This shouldn’t be surprising. Who are you going to bet gets the price right, an aspiring home buyer or analyst with access to oceans of data on prices and historic trends?

— Posted by Peter Z. Scheer

As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality beneath the headlines — without compromise.

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.