$10.9 Billion Ain’t What it Used to Be

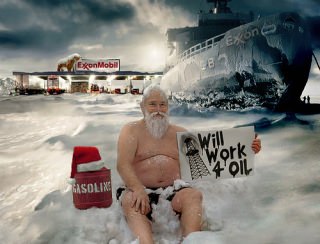

Exxon Mobil made $10.9 billion last quarter, but investors were disappointed that the world's biggest oil company had only its second-biggest quarter ever. With a product that is harder and harder to find, shareholders who demand even bigger windfalls and consumers who are about ready to revolt, you almost have to feel sorry for the oil companies. No, you really don't.

Exxon Mobil made $10.9 billion last quarter, but investors were disappointed that the world’s biggest oil company had only its second-biggest quarter ever. With a product that is harder and harder to find, shareholders who demand even bigger windfalls and consumers who are about ready to revolt, you almost have to feel sorry for the oil companies. No, you really don’t.

Your support matters…New York Times:

But even as it posted the second-most profitable quarter in its history, Exxon’s earnings managed to disappoint investors because of a drop in oil production. Shares were down about 5 percent Thursday after the company missed earnings estimates by a dime a share.

Record oil prices have lifted corporate profits to new heights throughout the industry but they are also masking an increasingly tough business environment for international oil companies, marked chiefly by rising development costs and stagnating hydrocarbon production. In the refining business, profit margins have plummeted as refiners have been unable to pass through all the increases in oil prices onto gasoline.

Extraordinary profits are also turning into a real, if somewhat incongruous, embarrassment of riches. Rising gasoline and diesel prices have ignited resentment among drivers and truckers, and are threatening to create a backlash against oil companies that could be especially resonant in an election year.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.