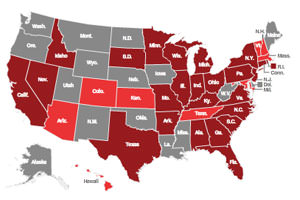

Half of States Have Run Out of Unemployment Funds

ProPublica reports that after paying out unemployment benefits to a record 20 million people, 25 states ran out of funds and now must borrow, tax and slash to keep the checks in the mail Find out how your state is doing with this handy tool.

ProPublica reports that after paying out unemployment benefits to a record 20 million people, 25 states ran out of funds and now must borrow, tax and slash to keep the checks in the mail. Find out how your state is doing with this handy tool.

Or check out the full article, excerpted below.

Your support matters…ProPublica:

Many states such as Virginia are already at or near the highest payroll tax rates allowed by law, and others have pushed politically difficult tax increases through their legislatures, making further benefit cuts likely if high unemployment persists, says Rich Hobbie, executive director of the National Association of State Workforce Agencies.

Some of the pain might have been avoidable. Long before the recession began, Virginia and many other states that have imposed tax increases or benefit cuts let their trust funds dwindle well below the 18 months of reserves the Labor Department recommends.

Virginia had to slow its need to borrow from the federal government despite the impact on businesses and seniors, says Republican state Sen. John Watkins, chairman of the Virginia Commission for the Unemployment Insurance Trust Fund. “I have angst for people who are unemployed,” he says. “But our trust fund is busted — it’s gone.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.