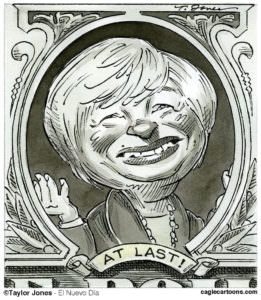

And Now, Some Slightly Better News from The Fed

On Wednesday, newly released minutes from the Federal Reserve's late-January meeting reflected a more optimistic stance vis-à-vis the next phase of the U.S. economy, but unfortunately, the slightly brighter outlook didn't extend to the Fed's take on the job market.

On Wednesday, newly released minutes from the Federal Reserve’s late-January meeting reflected a more optimistic stance vis-à-vis the next phase of the U.S. economy, but unfortunately, the slightly brighter outlook didn’t extend to the Fed’s take on the job market. –KA

Your support matters…Reuters via Google News:

Minutes of the Fed’s Jan. 25-26 policy session released on Wednesday suggested the consensus was still firmly aligned with completing the planned purchase of $600 billion in government bonds. A few Fed members questioned whether continued stronger data would call for curtailing the program.

Officials believed downside risks to the recovery were dissipating and there was no mention of a potential extension of the bond purchase plan, the minutes showed.

“Participants generally expressed greater confidence that the economic recovery would be sustained,” the minutes stated.

Despite that rosier assessment, policymakers expected only slow progress reducing unemployment and some said it was unlikely the recovery would strengthen so significantly that it would warrant curbing the bond buying plan.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.