Decade of the Living Dead

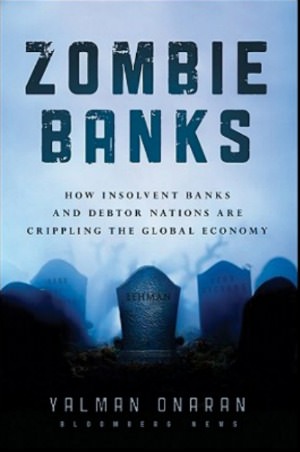

"Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy" is a grisly and horrifying true story of bloodsucking, flesh-eating, life-destroying fiends.

“Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy”

A book by Yalman Onaran

Yalman Onaran’s new book, “Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy,” makes it clear. The practice of subsidizing zombie banks (those that without support would be dead, but with support are the “walking dead” — sucking at our economic flesh through endless government life support), which began in the U.S. and was adopted in Europe, has dire ongoing economic implications for the global population. Onaran’s highly engaging prose is sometimes amusing, always scary in its content and imminently accessible to an economic layperson. He combines his considerable journalistic skills and powers of insight so concisely that the book can be read and digested in one or two sittings — depending on how much your stomach can take.

Onaran, a senior writer at Bloomberg News, admits right away that “although as a reporter I shy away from reflecting my own viewpoint in the articles I write, in this book, I did not pull any punches.” The result is a hard-hitting, exhaustively researched, passionately argued book.

Former FDIC Chairwoman Sheila Bair states in the book’s foreword, “[B]y propping up failing firms, we penalized the well-managed institutions and interfered with the basic function of the market.” She warns, “Governments around the globe continue to nurture and support a bloated financial sector built around an unsustainable model. …” And that is the problem — the model is unsustainable, yet politicians and central bankers continue to attempt to sustain it.

Onaran takes us on a global and historical journey of zombie banks, dotted with colorful anecdotes and searing analysis. He contextualizes zombie banks and Japan’s lost decade. Reading these chapters, I was reminded that we are already five years into our own lost decade, with no end in sight.

He moves on to the banking systems of Iceland (whose government chose not to sacrifice its population’s well-being to support zombie banks), Germany (whose Chancellor Angela Merkel has a love-hate relationship with zombie banks and the subsidies they are devouring out of Europe) and Ireland (which is a mess, held hostage by zombie banks).

Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy

By Yalman Onaran

Bloomberg Press, 184 pages

Onaran then turns to the United States. He exposes the U.S. zombies as capital deficient entities on “IV drip” and uncovers the political infighting, missed opportunities, the “extend and pretend” (extend money and pretend everything’s fine) mentality that prevents meaningful reform or policy change, and the path from zombie banks to the housing market crisis, laying blame where it’s due.

Finally, he focuses on the enduring risk of these zombie banks and their global implications. He makes it clear that regardless of whether U.S. banks lend to Greece, Ireland or Portugal, the fact that they are engaged in a complex $700 trillion derivatives market is more than enough to suffer tremendous reverberating losses.

In the last chapter, Onaran presents a set of well-reasoned, eminently accomplishable remedies for the problem of zombie banks. These include breaking up the big banks, a rigorous restructuring of debt that would involve U.S. zombies realistically evaluating and writing down the mortgage losses they carry, and European banks doing the same with sovereign debt. The weakest would have to be allowed to fall and the strongest to survive, rather than perpetuating an illusion of health while sucking in subsidies. Will this cause banks to take losses? Absolutely. But the alternative is our current slow burn through an economic hell.

|

To see long excerpts from “Zombie Banks” at Google Books, click here. |

After reading “Zombie Banks,” I interviewed Onaran. His responses underscore the importance of his book and the ongoing fallout of the widespread governmental subsidizing of zombie banks.

Nomi Prins: How would you rank the top U.S. banks from worst to least in terms of “zombieness”?

Yalman Onaran: No. 1 Bank of America, 2 Citigroup, 3 Morgan Stanley, 4 Goldman Sachs, 5 JPMorgan.

Prins: How does their zombie status hurt ordinary Americans?

Onaran: The zombieness of some of the largest banks hurts our economy because the zombies cannot fulfill their most important role of lending to consumers and companies. They try to use the money they get from the government to patch up their consistently bleeding wounds. They also make riskier bets with their money — such as writing complicated derivatives connected to the debt of troubled countries in Europe — which increases the likelihood that their final blowup will be even costlier to society than if they were stopped right now. That’s what happened in the past when zombie banks weren’t stopped in time. Taxpayers end up paying for the final mess every time and they will this time too.

Prins: Do you see us getting to a point where the zombie status is turned around?

Onaran: If the politicians wanted to kill the zombies, they could. The U.S. and many other countries have passed laws that allow them to wind down troubled banks. Even before the last crisis though, they could have done it. Politicians typically choose to muddle through though, which means letting the zombies live. If Obama finally decided to replace Geithner with a Treasury secretary more independent of the big banks, he could use Dodd-Frank reform’s resolution powers to take over and shut down the worst zombies. As presidential elections get closer and the economy refuses to improve, Obama might be tempted to go that route. Alternatively, if he loses the elections and the incoming Republican president decides to get tough on the banks, it could be done. I’m not very hopeful on either possibility though. Unfortunately, we’ll probably keep muddling through.

Prins: The OWS movement has demonstrated understandable, palpable anger toward the big banks — how can reading your book help them?

Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy

By Yalman Onaran

Bloomberg Press, 184 pages

Onaran

: OWS is reflecting the widespread anger throughout society toward the big banks because as unemployment lingers around 9 percent, the economy is stuck in an almost no growth zone, and bankers are back to paying themselves big bonuses and taking big risks while taking comfort from the government’s implicit guarantee to save them if their bets go sour, like in 2008. My book will give the OWS supporters a much better understanding of all the forces in finance and politics that play into this dirty game, help connect the dots between what’s happening here and in Europe. It will also help the OWS movement formulate concrete demands from our politicians so we can fix this mess. I lay out various steps the government can take to end the zombieness of the system, so the economy can move on.

* * *

If our leaders don’t adopt any of Onaran’s suggestions, the resulting blowup will be more horrific the next time around. Patching financial injuries by printing money doesn’t make the bleeding wounds go away. Onaran tells us we have to fix the problems or suffer the devastating consequences of zombie banks eating our economic flesh for years to come.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.