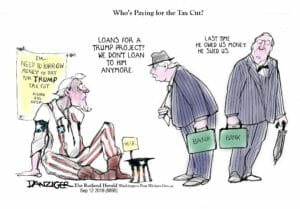

How Facebook Made a Billion Dollars, Paid No Taxes and Expects a Huge Refund

Despite making $1.1 billion after going public last year, Facebook didn't pay a dime in state or federal income taxes in 2012. Instead, thanks to the social media company's use of a single tax break, it anticipates getting a massive refund from the government totaling $429 million.

It’s good to be a corporation in America. Despite making $1.1 billion after going public last year, Facebook didn’t pay a dime in state or federal income taxes in 2012. Instead, thanks to the social media company’s use of a single tax break–the tax deductibility of executive stock options–it anticipates getting a massive refund from the government totaling $429 million.

What’s more, according to the nonprofit advocacy group Citizens for Tax Justice, Facebook is already planning for a massive tax break in the future stemming from its initial public offering. In total, the company’s “current and future tax reductions from the stock options exercised in connection with its IPO will total $3.2 billion,” the group points out.

Although Facebook serves as a useful example of what’s wrong with the American tax code, it should be noted that it is hardly the only corporation taking advantage of, and profiting from, the stock option tax break.

Citizens for Tax Justice explains how it works:

Many big corporations give their executives (and sometimes other employees) options to buy the company’s stock at a favorable price in the future. When those options are exercised, corporations can take a tax deduction for the difference between what the employees pay for the stock and what it’s worth (while employees report this difference as taxable wages). Before 2006, companies could not only deduct the “cost” of the stock options on their tax returns, reducing their taxable profits as reported to the IRS, but they also didn’t have to reduce the profits they reported to their shareholders in the same way, creating a big gap between “book” and “tax” income.

Some observers, including CTJ, have argued that the most sensible way to resolve this incongruity would be to deny companies any tax or “book” deduction for an alleged “cost” that doesn’t require a dime of cash outlay. But instead, rules in place since 2006 now require companies to lower their “book” profits to take some account of options. But the book write-offs are still usually considerably less than what the companies take as tax deductions. That’s because the oddly-designed rules require the value of the stock options for book purposes to be calculated — or guessed at — when the options are issued, while the tax deductions reflect the actual value when the options are exercised. Because companies typically low-ball the estimated values, they usually end up with bigger tax deductions than they deduct from the profits they report to shareholders.

A November 2011 CTJ report assessing the taxes paid by the Fortune 500 corporations that were consistently profitable from 2008 through 2010 identified this stock option tax break as a major factor explaining the low effective tax rates paid by many of the biggest Fortune 500 companies

— Posted by Tracy Bloom.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.