Big Banks Trying to Kill Off Credit Unions

In an effort to gain even more control of Americans' banking assets, the banking industry is trying to stamp out member-owned credit unions -- which began amid the banking failures of the Great Depression -- by stripping them of their nonprofit status.

In 1934, as U.S. banks were dropping like flies, Congress approved the Federal Credit Union Act that gave federal backing — and nonprofit status — to cooperatives to fill the void left by the collapsing banking system. It was collective action at its fundamental best.

Since then, the banking industry has come to rule the world — at least it feels that way — as those federally chartered credit unions continued to use their nonprofit status to offer lower fees and rates in direct competition with for-profit banks.

Now the banking industry is aggressively lobbying Congress to strip credit unions of that nonprofit status, which would, in effect, turn them into banks. You can almost hear the evil cackles from the big banking boardrooms.

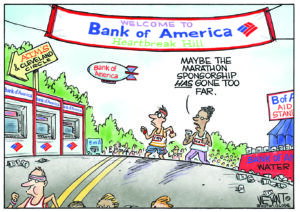

The showdown seems to have its roots in the Occupy movement, which lent its support to an uprising in 2011 against Bank of America’s plan to charge customers $5 a month to use their debit cards. Consumer groups, led by Move Your Money, urged customers to abandon for-profit banks in favor of credit unions. Millions did so, gaining the attention of the banking industry and leading Bank of America to scrap its $5 fee.

But the banks haven’t forgotten. Efforts to strip the credit unions of their nonprofit status have been bubbling for several months. In July, the Los Angeles Times reported:

Credit unions said the effort to take away their tax exemption was simply an attempt to stifle competition and remove one of the only checks on bank fees for consumers.

And it comes as some in Congress are pushing to loosen regulations on credit unions so they can expand their business further, including legislation that would lift a cap on the amount of money they can lend to businesses.

The tax exemption is crucial to credit unions, which by law can’t raise capital through public stock offerings the way that banks can, said Fred R. Becker Jr., president of the National Assn. of Federal Credit Unions, a trade group with about 3,800 federally chartered members.

“They’ll have to convert to banks, which is what the banks want,” he said. “Then they’d have, for lack of a better term, a monopoly.”

As Congress works on a possible overhaul of the federal tax codes, the banking industry has been pressing the issue hard. Credit union supporters have been pushing back too with their own campaign (you can join here), though the prognosis remains murky.

But you can be sure that if the banks are too big to fail now, they’ll be even more powerful — and their rates and fees unchecked — if they manage to stifle the only real competition out there.

—Posted by Scott Martelle.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.