Banks Rejected Three Out of Four Requests for Loan Modifications Under Vaunted Obama Program

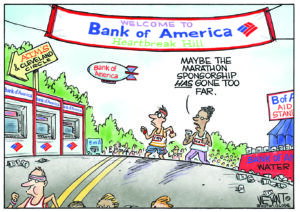

One of the Obama administration’s “signature efforts to help homeowners” has “allowed big banks to run roughshod over borrowers again and again,” reports The New York Times. Daniel Arauz / CC BY-SA 2.0

Daniel Arauz / CC BY-SA 2.0

The Home Affordable Modification Program — one of the Obama administration’s “signature efforts to help homeowners” — has “allowed big banks to run roughshod over borrowers again and again,” reports The New York Times.

Instead of helping some four million borrowers get loan modifications […] banks participating in the program have rejected four million borrowers’ requests for help, or 72 percent of their applications, since the process began. From the outset, Treasury’s loan modification program had problems. Among them were two design flaws: making the program voluntary for the banks and letting those banks that participated run the process on their own. …

CitiMortgage, a unit of Citibank, had the worst record, rejecting 87 percent of borrowers applying for a loan modification. JPMorgan Chase was almost as bad, with a denial rate of 84 percent. Bank of America turned down 80 percent, and Wells Fargo rejected 60 percent.

A typical homeowner’s experience, the Times wrote, went as follows:

After Lucy Circe became disabled and could no longer work, she applied to Bank of America for a mortgage loan modification on her Vermont home. Over more than two years, starting in 2012, the bank repeatedly requested copies of documents that had already been provided, asked for proof that she was no longer married to a man she did not even know, and made other errors, like asking why Ms. Circe had indicated that she didn’t want to keep her property when she had actually told the bank she did.

Read more here.

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.