Why Corporate Tax Deserters Shouldn’t Get the Benefits of Being American Corporations (Video)

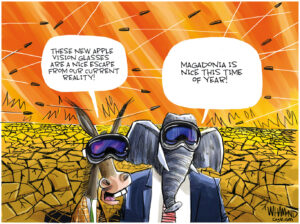

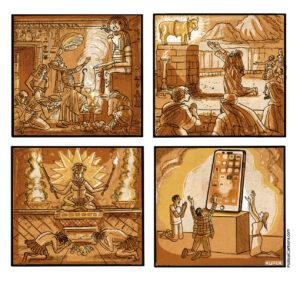

Apple is only the latest big global American corporation to use foreign tax shelters to avoiding paying its fair share of US taxes It’s just another form of corporate desertion Apple is only the latest big global American corporation to use foreign tax shelters to avoiding paying its fair share of U.

Apple is only the latest big global American corporation to use foreign tax shelters to avoiding paying its fair share of U.S. taxes. It’s just another form of corporate desertion.

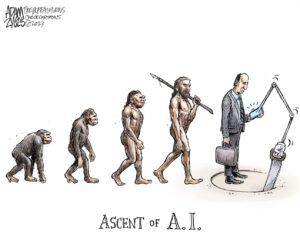

Corporations are deserting America by hiding their profits abroad or even shifting their corporate headquarters to another nation because they want lower taxes abroad. And some politicians say the only way to stop these desertions is to reduce corporate tax rates in the U.S. so they won’t leave.

Wrong. If we start

trying to match lower corporate tax rates around the world, there’s no end to it.

Instead, the President should use his executive power to end the financial incentives that encourage this type of corporate desertion. President Obama has already begun, but there is much left that could be done.

In addition, corporation that desert America by sheltering a large portion of their profits abroad or moving their headquarters to another country should no longer be entitled to

the advantages of being American.

1. They shouldn’t be allowed to influence the

U.S. government. They shouldn’t be allowed to contribute to U.S. political

campaigns, or lobby Congress, or participate in U.S. government agency

rule-making proceedings. And they no longer have the right to sue foreign

companies in U.S. courts for acts committed outside the United States.

2. They shouldn’t be entitled to generous

government contracts. “Buy American” provisions of the law should be

applied to them.

3. Their assets around the world shouldn’t any longer be protected by the U.S. government. If their factories and equipment are expropriated somewhere around the world, they shouldn’t expect the United States to negotiate or threaten sanctions, or use our armed forces to protect their investments. And if their intellectual property – patents, trademarks, trade names, copyrights – are disregarded, that’s their problem too. Don’t expect any help from us.

In fact, their

interests should be of no concern to the U.S. government – in trade

negotiations, climate negotiations, international treaties reconciling

American law with the laws of other countries, or international disputes over

access to resources.

They don’t get to be represented by the U.S. government because they’re no longer American.

It’s simple logic. If corporations want to desert America in order to pay less in taxes, that’s their business. But they should no longer have the benefits that come with being American.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.