Truthdigger of the Week: David Cay Johnston

The dogged investigative reporter uses plain language to describe the congressionally prescribed byzantine tax schemes that cheat ordinary Americans to benefit financial elites.

By Alexander Reed Kelly and Peter ScheerEvery week the Truthdig editorial staff selects a Truthdigger of the Week, a group or person worthy of recognition for speaking truth to power, breaking the story or blowing the whistle. It is not a lifetime achievement award. Rather, we’re looking for newsmakers whose actions in a given week are worth celebrating.

Since Ronald Reagan and his successors in government began restructuring the tax code, American society has become increasingly unfair. Because of wide-ranging investigative reporters like David Cay Johnston, those of us with time and concern have the opportunity to learn a little about it.

A Pulitzer Prize-winning author who has covered economic and tax matters for major newspapers and other media over the last four decades, Johnston had the cover story in Newsweek magazine in late August and early September for two weeks running. The first account detailed the serial fabulism of widely respected late celebrity biographer C. David Heymann (as well as the complicity of his publisher Simon & Schuster and its parent company CBS). The second, which makes up the substance of this article, examines some of the ways in which Congress helps major corporations and investors reap huge profits by turning tax bills into zero-interest loans subsidized multiple times over by the American taxpayer, and includes a description of how such loopholes were used to help finance the recent tax-avoidance merger of fast food chains Tim Hortons of Canada and Burger King.

The profit-enlarging tax program utilized by more than 360 companies with upward of 7,800 international tax haven subsidiaries is convoluted and seemingly paradoxical. Between 2008 and 2012, 25 of those companies paid no taxes and instead received money from the government.

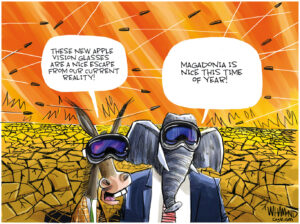

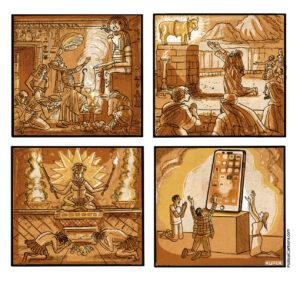

Contrary to the privileges allowed to the average taxpayer, Johnston explains, the rules written by Congress encourage some multinational corporations to defer the payment of taxes for years or decades, and in some cases forever. Apple and GE are reported to have at least $36 billion in such deferments, Microsoft nearly $27 billion and Pfizer $24 billion. One way companies qualify for these delays is by using their profits to pay offshore offices various fees involved in the course of business, for example, “royalties for the use of patents, logos and manufacturing techniques.”

“This converts profits earned in the U.S. into tax-deductible expenses,” Johnston writes. “You could do the same thing by moving a dollar from your left pocket to your right.” But unlike the corporations, you would not get to deduct it at tax time.

Even investor Warren Buffett, who has publicly campaigned for higher taxes on affluent individuals like himself, has used such tax rules. Buffett, who came out publicly in favor of a minimum tax on the wealthy and an increase in the estate tax, famously noted that his secretary pays a higher percentage of her income to the government than he does of his. He is an affable figure from the American heartland who has given billions to charity and supported progressive causes, distinguishing himself from the stereotypical financier. But as an investor, Johnston contends, Buffett has taken advantage of legal tax rules for decades. Through his Berkshire Hathaway stock holding company, Buffett enjoyed $57 billion worth of the U.S. Congress’ generous “interest-free loans” last year; investing them brought the company an extra $5 billion. Part of this stockpile was used to help fund the Burger King-Tim Hortons deal.

The tax deferments may seem harmless, but the value-diminishing effect of currency inflation wrought between the time of deferment and the year it comes due means the amount a corporation finally pays the government will be far less in actual dollar value than it would have been during the year it was initially due. The effect is less income for the government. “No bank will give you this deal because it would almost instantly go bust, paying out many times in interest what it would collect to close out the loan,” Johnston writes.

This is where taxpayers get screwed. The government does not reduce its spending because corporations defer their taxes. To help make up for the difference between revenue and spending, “Congress lets companies use the tax money they did not pay to buy Treasury bonds, which pay interest,” Johnston points out. In other words, the government “pays companies to delay turning over their taxes, and it makes [taxpayers] pay the interest.” In some cases, Johnston reports, the government — meaning the taxpayers — will pay $4 of interest for each corporate tax dollar it collects down the road. “The government loans money to big companies interest-free, then borrows it back with interest,” he notes.

Johnston describes how a company, as in the Burger King-Tim Hortons deal, can use the resultant bigger profit margin to “build financial muscle … to smack competitors” in the same industry.

“Anyone who can earn profits in a high-tax country and then move them to a haven where no tax is owed should ravage the competition,” Johnston writes. By giving Burger King an advantage over McDonald’s, Wendy’s and other fast food businesses, the workaround helps consolidate the hold that Burger King’s owner, Brazil-based 3G, has globally on the beverages, fast food and condiments industries.

The total worth of 3G is in the range of hundreds of billions of dollars and growing. And, as Johnston illustrates, 3G and other such businesses that take advantage of these tax gimmicks move closer to an order of business in which they contribute no taxes to any public, but simply keep all of the profits they make to themselves. Never mind that the profitability of their operations is premised on the existence of taxpayer-funded and-maintained public utilities such as roads. “Fear that day,” Johnston writes. “As multinationals duck their U.S. taxes, you get stuck with the bill.”

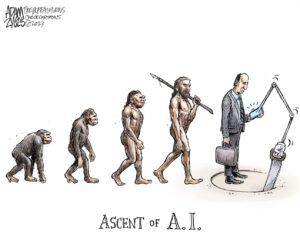

Johnston’s beat as a reporter isn’t glamorous, but through the decades his investigations have made headlines time and again. He is a talented writer, but he attributes his own success to the fundamentals. In an April interview on Truthdig Radio, Johnston lamented that not enough financial reporters today really understand basic math and accounting.

For a career of dogged reporting, and for describing in plain detail the byzantine tax schemes enabled by Congress that benefit financial elites, we honor David Cay Johnston as our Truthdigger of the Week.

TheRealNews:

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.