To the Bailoutmobile!

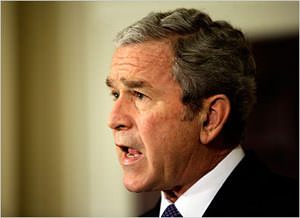

In an avowed effort to save capitalism from itself, President Bush announced Friday that he would throw the Big Three failing auto companies a $17.4 billion lifesaver, siphoning that money from the initial $700 billion bailout slush fund authorized by Congress in October.

In an avowed effort to save capitalism from itself, President Bush announced Friday that he would throw the Big Three failing auto companies a $17.4 billion lifesaver, siphoning that money from the initial $700 billion bailout slush fund authorized by Congress in October.

Your support matters…The New York Times:

President Bush announced $13.4 billion in emergency loans on Friday to prevent the collapse of General Motors and Chrysler, and another $4 billion available for the hobbled automakers in February with the entire bailout conditioned on the companies undertaking sweeping reorganizations to show that they can return to profitability.

The loans, as G.M. and Chrysler teeter on the brink of insolvency, essentially throw the companies a lifeline from the taxpayers that will keep them afloat until March 31. At that point, the Obama administration will determine if the automakers are meeting the conditions of the loans and will continue to receive government aid or must repay the loans and face bankruptcy.

The money to aid the automakers will come from the Treasury’s $700 billion financial stabilization fund and shortly after Mr. Bush’s announcement, the Treasury secretary, Henry M. Paulson Jr., who will oversee the aid to the auto industry, said Congress would need to release the second $350 billion for that program in short order.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.