The 2015 Federal Budget Ended Pension Protections for Millions of Retirees (Videos)

A rule sneaked into the new federal budget endangers retiring Americans by eliminating the government's legal obligation to insure pensions in the event the funds cannot pay retirees. Commercial airline pilots are among the types of workers whose retirement protections were removed in the 2015 budget. Photo by Dawn Huczek

Commercial airline pilots are among the types of workers whose retirement protections were removed in the 2015 budget. Photo by Dawn Huczek

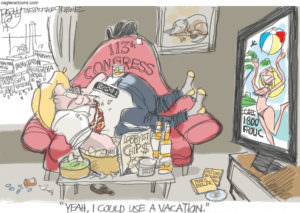

In the last few days of the 113th Congress, lawmakers sneaked a rule into the 2015 federal budget that endangers retiring Americans by eliminating the government’s legal obligation to insure pensions in the event the funds cannot pay retirees.

University of Missouri, Kansas City economist Michael Hudson explained the change on “The Hudson Report” at The Real News Network on Jan. 5.

Hudson explains that the final version of the budget declared as illegal a 1974 law that protected employee pensions. Now, if pension funds can’t raise enough money to pay their retirees, the funds can no longer go to the Pension Benefit Guaranty Corporation — a government insurance program — to make up the difference. The retirees will simply receive less money.

Specifically, Hudson says, “We’ve abolished the government guarantee on pension funds if the pension fund is run by a labor union,” meaning that it has “more than one employer contributing to it, like airline funds, truckers funds. … We’re going to give the fund managers, mainly the financial managers on Wall Street, the right to cut back on these pensions that are due.” Employees were promised this money during wage contract negotiations — and they often accepted smaller salaries because they understood their pensions would give them greater security in retirement.

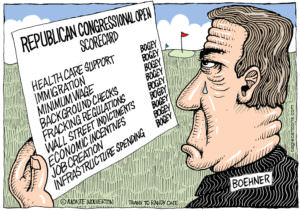

The change is not solely the Republicans’ doing, Hudson adds. “Democrats led this fight against labor a year ago.” But that fact is obscured to anyone who looks at the congressional record because lawmakers agreed they would not reveal who voted for or against amendments of its kind, he said.

Congress made the change in the name of balancing the budget. In effect, in the event of another 2008-style financial crisis, money that would have gone to retired workers will now be redirected to banks. The banks will get bailed out — but not the pensioners. (Greater bailout power was also granted in the budget, which overturned a key part of the financial reform passed in 2010.)

But pension funds were degraded even before the new budget threw the 1974 law out, Hudson notes. The funds were “set up in a way that they were guaranteed to lose”: Banks told the companies they could escape paying for the pensions if the companies allowed the banks to invest the money in the stock market. The banks promised returns of up to 8.5 percent a year. But that turned out not to be true, Hudson says. “They’re making — if they want to be safe… less than 1 percent a year.”

“So what they’ve done is they’ve gotten sort of desperate. … A lot of pension funds have gone to hedge funds and Wall Street. They’ve gone to Wall Street money managers and said, look, can you — we’re desperate, we’re going to have to go under; can you help us make more money? Well, the Wall Street sharpies think, well, OK, sure, we’re going to put your money in derivatives and other things. And the banks that have been managing these funds, like Goldman Sachs and Northern Trust, have actually done very badly.”

And the government and financial industry have tried to pin the trouble on the poor. “The whole idea,” Hudson says, is that “a few years ago there were, like, four workers for every retiree, so it was easy for the workers to pay into the funds and organize it … there was enough to pay. But now that the economy’s been de-industrialized, there are more retirees for every worker. So the Obama administration is saying, well, the problem is that there are just not enough workers to pay. Sorry, they lose.

“But the Congressional Budget Office has found that that’s really not much of the problem at all. A lot of the problem is that” the Wall Street people who were entrusted with the pensions “are just as crooked as the mafia” — which often managed pensions before Wall Street. The financial firms pocket the profits and shove the losses onto their clients. “That’s pretty much what Wall Street’s been doing with the pension funds,” Hudson says. “They keep the gains for themselves and pay themselves bonuses and high salaries, and the losses are all stuck to Orange County or Detroit or Birmingham, Alabama, or other public funds.

“There have been a number of lawsuits where Wall Street’s had to give back the money,” he adds. “And they’ve all been accused of fraud.” But the banks are allowed to continue operating because, as the government said in 2008, they are “too big to fail.” So now “Wall Street has realized that there is nothing to stop them.”

Hudson, who worked on Wall Street and thus has insight into how financial executives think, says this degradation of retiree funds is part of a plan to privatize pensions and Social Security. The strategy is to eliminate the government’s ability to protect retirees’ savings and force them into the arms of private banks.

“The argument’s going to be made to American workers, well, wait a minute, you’ve seen your pension funds aren’t able to pay, you’ve see them lose money on derivatives. There’s only one way to be safe: take responsibility for yourself, and you manage your own money in the 401(k)s and the other personal programs. … And by making your own choice, what this really means is the individual employees are going to have to turn over their funds to the same Wall Street companies — Goldman Sachs and Northern Trust — that have … mismanaged the corporate pension funds and the union pension funds.

“And so the whole idea is that all of a sudden, now that employment is not growing, now that wages are not growing, instead of making profits by underpaying labor, Wall Street’s going to make profits just by siphoning off all of the savings that have been put aside in advance to pay the pensions. The argument will be, I’m sorry, folks, there’s not enough to pay the pensions, or the Wall Street calculators who made these forecasts made a terrible mistake. Unfortunately for you, under the law that Congress has just rewritten, not only do they get paid before you, but we’ve just canceled the government’s responsibility to insure you. We’ve taken away your insurance.” [Emphasis added.]

Hudson’s main points were confirmed on C-SPAN in December by Karen Friedman, executive vice president and policy director of the Pension Rights Center:

Hear Hudson speak on The Real News Network here: Read Hudson’s own article on the pension-budget topic at CounterPunch here.— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.