Shift to Bad Retirement Plans Threatens Retirees With Privation

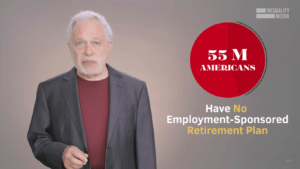

The United States' largest employers are knowingly pushing their workers into inadequate retirement plans.

The United States’ largest employers are increasingly pushing their workers into inadequate retirement plans — and they acknowledge doing so.

Christopher Flavelle reports at Bloomberg:

A survey last month from Towers Watson, the employee benefit consultant, shows just how rapidly the defined-benefit plan — the traditional pension that guarantees workers an annual income after they retire — has moved from the norm at Fortune 500 companies to all but extinct. In 1998, just more than half offered new hires a defined-benefit plan; by 2013, that had fallen to just 7 percent.

That trend continues: According to Towers Watson, at least three of the 34 Fortune 500 companies that offered defined-benefit plans to new hires last year won’t do so this year.

Taking their place are defined-contribution plans, the 401(k)s and other such plans in which employers put money into an investment account in the worker’s name. In theory, employees can still save enough for retirement — if they put enough away, invest it wisely and engage in reasonable planning. But that’s not what usually happens — and according to another Towers Watson survey of large employers, they know it.

In 2012, Towers Watson asked 371 companies how well their employees understand and make good use of their retirement plans. In most cases, the companies answered that workers fail to use the plans to their benefit.

Flavelle continues:

Defined-contribution plans rely on the premise that workers are making rational, informed decisions about their retirement. So companies’ responses are akin to admitting that the defined-contribution system is failing many of their employees. Which raises the question: If employers don’t think their workers can manage the shift to defined-contribution retirement plans, why make that shift?

Indeed. The relevant question is, whom does the shift benefit and how?

— Posted by Alexander Reed Kelly

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.