Is Crypto the Greatest Scam in History?

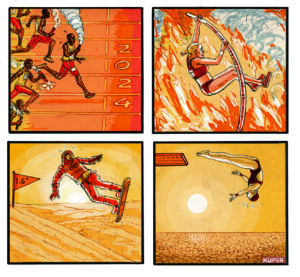

A new book argues that far from addressing global challenges, crypto and blockchain make everything worse. (Image: Adobe)

(Image: Adobe)

Peter Howson once embraced cryptocurrency and blockchain technology.

The conservationist and international development researcher was intrigued by their potential to solve complex problems, like mitigating climate change and protecting the world’s most vulnerable. In 2016, he was working in Indonesia on efforts to conserve land for Indigenous communities in a place where such projects had failed and sometimes ended in horrific violence and displacement.

Howson learned of a project to allow local people to receive financial rewards via cryptocurrency for planting trees. Excited by the possibilities, he ended up developing a project in England and began to promote crypto and blockchain initiatives around the world to help ensure sustainability, track the supply chain of products and provide financial inclusion for those left behind. Like many devoted to positive change, he hoped the technologies could lead to a new era of openness, transparency and equity.

But there was a problem. After years of tracking these projects and poring over every aspect of their social, economic, environmental and political impact, he found that rather than helping, they made everything worse. Far from promoting sustainability and democratic ideals, crypto was the “greatest scam in history.” Today, Howson sees blockchain technology as utterly lacking in any social benefit. It’s a technology, he says, that hinders progress on climate change and economic and social inequality, exacerbating our most urgent problems while beguiling us with idealistic illusions.

By the time the pandemic struck, Howson regretted ever advocating what amounts to high-tech snake oil, and now makes amends with “Let Them Eat Crypto: The Blockchain Scam That’s Ruining the World,” published this October by Pluto Press. To read the book is to plunge into a world of “industrial scale scumbaggery,” “vacuous buzzwords” and “the next hottest shitcoin” — a place where markets appear from thin air and suckers materialize every nanosecond.

It’s a technology, Howson says, that hinders progress on climate change and economic and social inequality, exacerbating our most urgent problems while beguiling us with idealistic illusions.

The book exposes the hollowness of the hype surrounding crypto, Gen Z’s favorite investment, as well as the much-touted underlying technology, blockchain, often hailed as the foundation of the future internet, or Web3. Howson’s analysis traces the journey of crypto from its early days as an object of fringe fascination for techno-libertarians to an instrument of exploitation more likely to bring environmental harm, misogyny, oppression and extractive colonialism to the world than empowerment or emancipation.

The author aims his guns squarely at the trusted politicians, duped do-gooders, respected thought leaders and smiling celebrities who have greased the wheels of the crypto gravy train. The whole monstrous machine, he argues, is merely a turbocharged form of finance capitalism. Instead of reimagining money, crypto boosters funnel it into the hands of those who need it least. New tech: old story.

Truthdig spoke with Howson about why he believes crypto is a brazen warp-speed scam that is eroding democracy, entwining with far-right extremism and flourishing in regions of glaring inequality and political turmoil. The transcript below has been edited slightly for length and clarity.

Truthdig: Investing in crypto might sound foolish to some at this point, especially with Sam Bankman-Fried in the headlines, but you claim the situation is far graver than many realize. Most crypto projects, you argue, are inherently fraudulent. How so?

Peter Howson: A few good books have come out recently showing the scamminess of crypto, but they suggest that it’s just another example of what Charles Mackay called the “madness of crowds” in his classic book on market psychology. A couple of years ago, I was phoned by a journalist from the Daily Mail tabloid writing a piece about the NFT craze [NFTs are a type of crypto art]. He and his kid had drawn a self-portrait and were going to mint it as an NFT. He wanted to know how much you could get for it based on other NFT collections that sold for loads of money. I warned him that all of those collections have been wash traded.

Truthdig: By “wash trading” you’re talking about the hustle where traders fake market activity by buying and selling the same asset to inflate its price?

PH: Yes. It’s a type of scam. I told him that’s the reason the prices are so high. Crypto, NFTs and other things that rely on blockchain aren’t just cases of market mania or popular delusion. They may look like crazy bubbles, but they’re really fraud. Journalists typically have a narrative of “aren’t people stupid?” they want to tell. If I point out that there’s a lot of criminal activity, they get nervous because then they’ll have to point fingers and face defamation and evidence issues which are difficult given the pseudonymous nature of these technologies.

Truthdig: The crypto-verse is big on using pseudonyms to shield peoples’ identity.

PH: Right.

Truthdig: By now, though, the public is hearing real names linked to alleged criminal activities, such as crypto-king Bankman-Fried, recently convicted for stealing from customers of his now-insolvent cryptocurrency exchange, FTX, in one of the biggest financial frauds ever recorded.

PH: Yes, and that person can become a kind of scapegoat.

Truthdig: Some call him a bad apple, but argue the whole barrel isn’t tainted, right?

PH: Exactly. Crypto is a scam built on criminality and fraud such as wash trading and various other market manipulation tactics. This isn’t like tulipmania or the South Sea Bubble or the Teletubbies toy craze in Britain. It’s fraud. And this fraud has huge environmental and social consequences for people who want nothing to do with crypto.

Truthdig: Let’s talk about the heavyweights. You mention that 2% of Bitcoin owners, the “whales,” control a whopping 92% of all in circulation. How do these hidden whales shape the crypto world?

PH: We know who some of them are because they’re very vocal about it, like Cameron and Tyler Winklevoss, who often claim that they were the first members of the Vladimir Club, an exclusive club for anyone who owns at least 1% of the circulating supply of Bitcoin. Whales can move their stash between exchanges and between various crypto tokens. They can create hype and pump up whatever tokens they choose. FOMO investors see this upward price trajectory and want a piece of the action. Then the whale can simply pull the rug out from under the retail investors who don’t have access to high frequency trading platforms.

Truthdig: What happens to regular folks who thought they were onto something big?

PH: They lose all their student loan allowance for the semester. Or their pension. The whales, the large majority holders, walk away with even more money. This stuff preys on the little guy who doesn’t have access to the resources the whale investors have. You can’t beat the whales. The system is completely unregulated and it’s rigged in their favor.

One of the biggest institutional investors of Bitcoin is billionaire Michael Saylor, co-founder of a company called MicroStrategy. He’s the queen bee of the Bitcoin hornets, mustering his following to do whatever he says just on the weight of his token holdings. He’s done this openly. He’s set up the Bitcoin Mining Council, a body which is trying to enhance the image of crypto in very profound ways, like “greenwashing” [making crypto look environmentally friendly] and bringing big tech players like Elon Musk into Bitcoin and the crypto space generally.

A lot of the wash trading and market manipulation is done underground and pseudonymously so we don’t know who is doing it, but in other ways it’s very, very open. That’s deliberate, to try and get people to jump on the gravy train.

Truthdig: Blockchain, the technology underlying crypto and Web3, is often hailed as groundbreaking. But it seems complicated to explain. Unlike other tech innovations like ATMs or GPS, it leaves people puzzled. What gives?

PH: There was a massive cryptocurrency nosedive in 2017 when the whole space could have just collapsed and vanished, but it didn’t because some very influential people got involved. Ethereum, the second biggest cryptocurrency after Bitcoin, had launched 2015 as a general purpose blockchain that was going to offer all these wonderful services that Bitcoin had failed to do, like “smart contracts,” which are agreements in the form of computer code that execute automatically, without third parties. There was a network of very leading tech people around Ethereum, like Marc Andreessen, who developed the first web browser, and MIT people influential in the policy arena around the web space.

They came together to formulate this Web3 ideology, you could call it, and got the ear of people like the head of the U.N. and Barack Obama. If they could get these prominent figures to help tout the wonders of Web3, they could create smoke to hide behind. They could get them to say, “Hey, there is something important here! We don’t really know what it is yet. But it’s important that regulators don’t really come in and squash it.”

This is a farce. There’s really no innovation in blockchain or Web3. An innovation surely has to be more than just a novel application: It has to be useful. These things don’t serve human flourishing in any way. They don’t make our society or environment better. In fact, they make them profoundly worse.

Truthdig: You argue that blockchain ideology is destabilizing our democratic institutions and undermining our responses to major challenges.

PH: Yes. Bitcoin was put together by the “cypherpunks,” an underground forum of software developers, which included people like Julian Assange. These guys believed that any government interference in the smooth running of the free markets is a slippery slope to serfdom. So they made Bitcoin as a way to prevent governments from interfering with the money supply. Back in 2008 and 2009, people were crying out for this. I guess it was meant to be a kind of proof of concept idea, something that proved it was possible to have a system of money that didn’t rely on governments or centralized intermediaries. But I would say it went too far.

The cypherpunks fudged together old technology that had been around since 1997 and made Bitcoin to take away power from governments. That might sound like a noble idea, because governments do horrible things. But governments do good things, too, and they do them very well, even when they’re very under-resourced. I think the Bitcoin advocates really wanted to subvert the state and its ability to manage the money supply so that our economy works for society as a whole, including the poor. Whatever is wrong with the state, it is the system of democracy we have. We have an elected government. To have blockchains and cryptocurrencies whose goal it is to undermine those institutions is obviously going to make things worse.

Truthdig: You point out that right-wing political agendas are intertwined with crypto and blockchain. Let’s talk about Texas. Why is this conservative state a crypto hotspot?

PH: It goes back to the whole purpose of Bitcoin and cryptocurrency. Proponents call crypto “decentralized,” but in reality it’s far more centralized than the financial system we have. Back in 2020 and 2021, the vast majority of crypto miners were in two parts of China. But the Chinese government put their foot down because the Bitcoin miners were making an environmental mess, restarting dirty coal fired power plants that were closed down for climate change reasons.

The miners had two options: pack it in and take the hit in terms of all these expensive specialized computers, or go overseas with their machines. A lot of them ended up in places like Kazakhstan, but now even Kazakhstan has put their foot down because it has an energy shortage and the mining is disastrous for local people.

Then there’s Texas, the Lone Star state. Texas struggles to balance its power grid during periods of peak and low demand. They had the bright idea to throw open the doors to Bitcoin miners and outfits that can come in and pay very little for energy. Now they’re all there. The U.S. has taken over China as the global crypto superpower and Texas is the state where most of the Bitcoin is mined today. Recently, there was a week of action in Texas led by Jackie Sawicky, founder of the Texas Coalition Against Cryptomining. They’re trying to show regulators the profound impacts on local communities, not just in terms of energy bills, but water use in a state that can’t plant fields because there isn’t enough water.

In Texas, there’s an ideological commitment to free-market neoliberalism. They don’t want to upgrade the grid that’s years past its use-by date and admit that maybe free markets and their use in a natural monopoly has reached its limits. Texas is a welcoming place for Bitcoin miners.

Truthdig: There’s a lot of talk now about sustainable crypto. Some platforms claim to be environmentally responsible, getting rid of mining and using carbon offsets. Bitcoin and other cryptocurrencies use the energy-sucking Proof-of-work mechanism, where people who validate transactions use a lot of computer power, but the newer Proof-of-stake alternative is supposed to be more energy efficient. What’s your take?

PH: The playing field is shifting constantly. In 2022, Ethereum completed what’s known as “The Merge,” when the platform changed from Proof-of-work to Proof-of-stake. That addressed some of the negative environmental impacts of crypto and NFTs. The Ethereum token Polygon was originally marketed as this environmentally friendly NFT platform because it didn’t completely rely on the dirty Ethereum PoW mining. A lot of platforms have sprung up trying to market themselves in a similar way.

Still, NFTs are just dumb for lots of reasons. Some NFTs are worse-than-nothing solutions to environmental challenges. NFTs are being used as a way of trading carbon credits, for example, but as soon as you put the carbon credits on a blockchain, they become divorced from reality, from the forest you’re trying to save. People trade in them thinking they’re doing something positive for the environment when at best they’re doing nothing and at worst these credits are being sold as pollutant permits. They’re chugging pollution into the environment thinking it’s all carbon neutral. There are loads of problems with those sorts of NFTs no matter what the marketing says. And there are still NFT platforms minting tokens on the Bitcoin blockchain, and that’s terrible: a Bitcoin NFT might have the same embodied carbon emissions as the average household uses in three months.

Truthdig: You argue that we need a coordinated global ban on crypto. Why go that far?

PH: By 2019, Bitcoin alone was already producing more carbon dioxide than Argentina. It was putting out four times more carbon into the atmosphere than Europe’s most polluting power station. And it’s only gotten bigger. It’s urgent to address that.

But I would go as far as to say that cryptocurrencies and blockchain have proven themselves to be highly destructive technologies which in no way can be understood to be innovations because they serve no positive function for society. In that respect, they’re like mustard gas, polystyrene, lead in gasoline — all these crappy ideas we had to get rid of. With chlorofluorocarbons, the world came together and signed agreements that got rid of them. The UN has shown this can be done. We should apply the same logic to cryptocurrencies and blockchain. A lot of policymakers are jumping on the crypto bandwagon these days. But again, the cypherpunks put this technology together to subvert the state. Ironically, the state is now the only thing holding this all together, even though the public really wants to get rid of crypto.

Truthdig: So crypto has infiltrated the state?

PH: Definitely. The state is an integral part of crypto now, with many officials trying to muster up legitimacy for what is just an enormous scam. In the U.K., the prime minister said he wanted the Royal Mint to launch an NFT for a Global Britain. When a regular person hears this, they’re going to think this stuff is legit because there is no higher authority in the country. Then we have Boris Johnson, as soon as he left office, taking a contract at a Bitcoin outfit in Singapore and touting blockchain as a wonderful thing. Some of the biggest donors in the U.K. and the U.S. are crypto lobbyists. The size of the crypto lobby in the U.S. is bigger than Big Pharma and Big Arms put together, or at least it was, pre-Bankman-Fried.

Truthdig: You’ve called crypto “the biggest scam in human history.” Very strong words!

PH: I would say it is. Look at the size in dollar value. Bernie Madoff’s Ponzi scheme was several billion, but the FTX fraud could end up being much bigger. Many Madoff investors did get something back. That’s not going to happen for many with FTX. And it’s not just rich American investors. It’s not just pension funds. The FTX fraud ruined the lives of some of the poorest people in the world — people in west Africa were being recruited for FTX projects. When you add together everyone who has been scammed by crypto, it will be far beyond any Ponzi in history. Adjusting for inflation, it’s probably bigger than the South Sea Bubble, bigger than tulipmania.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.