How Much Money Would Bernie Sanders’ Tax Proposals Save or Cost You? This Calculator Will Tell You

Scared that Sanders would raise your taxes? Many people are, especially after reading what The Nation describes as Vox’s “wildly misleading” calculator of income taxes under the policies of various presidential candidates.

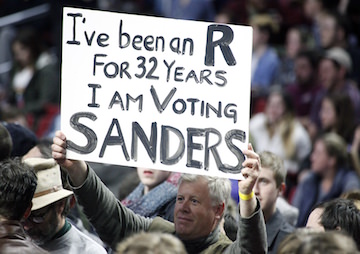

A conservative expresses support for Democratic presidential candidate Bernie Sanders in Philadelphia this week. (Star Shooter / MediaPunch / IPX)

Scared that Sanders would raise your taxes? Many people are, especially after reading what The Nation describes as Vox’s “wildly misleading” calculator of income taxes under the policies of various presidential candidates.

Economists Mark Paul and David Rosnick and Gravity Switch CEO Emily Stephens write at The Nation:

Vox’s calculator, despite its catchy headline, does not show how your overall economic situation might change under each candidate’s policy agenda. What it presents is a number Vox calls “your tax liability,” which includes things you would never think of as part of your tax bill—like the payroll taxes your employer pays on your wage or the tax you pay on a bottle of wine. Using Vox’s approach, which draws on a narrow, but largely correct, analysis from the Tax Policy Center (TPC), simply getting a raise from your boss would look like a larger tax bill—bad news. As a result, Vox’s calculator overwhelmingly favors Trump and Cruz, while suggesting that Sanders’s plan would have a negative effect on disposable income for the majority of Americans.

This is all a bit misleading. Final take-home pay—the amount of money you get to spend after the government takes its share and you have paid the cost of health insurance—has an exponentially larger effect on your life than your tax rate. Contrary to what is implied in Vox’s calculator, TPC finds that under the Sanders plan, middle-income the take-home pay of earners with employer-provided healthcare increases.

A key part of the Sanders plan, for example, is health insurance. In Vox’s calculator, your tax rate increases to fund Sanders’s Medicare-for-All plan. But they’re not accounting for the fact that your employer will no longer be paying for your health insurance. Will you pay more taxes? Yes. But if your employer currently pays for your insurance, as is the case for about half of Americans, then companies’ newfound savings under Medicare-for-All will be passed onto you in the form of higher wages.

The impact of this healthcare system would be huge. The Kaiser Family Foundation finds that the average employer-sponsored insurance costs $17,545 for a family plan, and $6,251 for single coverage. Under the Sanders plan, employers would pay an additional 6.2 percent in payroll taxes and individuals an additional 2.2 percent tax to finance health insurance. Many Americans come out ahead in the calculation once we include this important detail.

Continue reading and use The Nation’s calculator to see what your after-tax take-home pay may look like under Sanders and other presidential candidates here.

Who are the experts behind these findings? Mark Paul is a research affiliate at the Samuel DuBois Cook Center on Social Equity, Duke University, who teaches economics at the University of Massachusetts Amherst. David Rosnick is an economist at the Center for Economic and Policy Research. And Emily Stephens, in addition to being CEO of Gravity Switch, is an independent researcher who studied economics and international women’s health at the UMass Amherst.

—Posted by Alexander Reed Kelly.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.