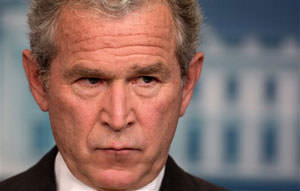

Bush’s Economic Policies Bankrupted U.S., Reagan Budget Director Says

David Stockman, who served as Ronald Reagan's budget director from 1981 to 1985, leveled some harsh criticism at his former boss as well as at President George W. Bush in an op-ed he penned about the dire state of the economy for The New York Times titled "Sundown in America."

David Stockman, who served as Ronald Reagan’s budget director from 1981 to 1985, leveled some harsh criticism at his former boss as well as at President George W. Bush in an op-ed he penned about the state of the economy for The New York Times titled “Sundown in America.”

“The destruction of fiscal rectitude under Ronald Reagan — one reason I resigned as his budget chief in 1985 — was the greatest of his many dramatic acts,” Stockman writes. “It created a template for the Republicans’ utter abandonment of the balanced-budget policies of Calvin Coolidge and allowed George W. Bush to dive into the deep end, bankrupting the nation through two misbegotten and unfinanced wars, a giant expansion of Medicare and a tax-cutting spree for the wealthy that turned K Street lobbyists into the de facto office of national tax policy. In effect, the G.O.P. embraced Keynesianism — for the wealthy.”

As The Huffington Post noted, “Stockman may have a point when it comes to Bush’s policies, at least. The cost of the wars in Iraq and Afghanistan combined with the Bush-era tax cuts for the wealthy will account for nearly half of the debt the U.S. will owe by 2019, according to a February analysis from the Center on Budget Policy and Priorities, a left-leaning think tank.”

Stockman’s attack extends far beyond just Reagan and Bush, however; his piece also targets lawmakers, Wall Street, the Federal Reserve and Treasury officials as he paints a bleak picture of the American economy.

David Stockman in The New York Times:

Without any changes, over the next decade or so, the gross federal debt, now nearly $17 trillion, will hurtle toward $30 trillion and soar to 150 percent of gross domestic product from around 105 percent today. Since our constitutional stasis rules out any prospect of a “grand bargain,” the nation’s fiscal collapse will play out incrementally, like a Greek/Cypriot tragedy, in carefully choreographed crises over debt ceilings, continuing resolutions and temporary budgetary patches.

… THE state-wreck ahead is a far cry from the “Great Moderation” proclaimed in 2004 by Mr. Bernanke, who predicted that prosperity would be everlasting because the Fed had tamed the business cycle and, as late as March 2007, testified that the impact of the subprime meltdown “seems likely to be contained.” Instead of moderation, what’s at hand is a Great Deformation, arising from a rogue central bank that has abetted the Wall Street casino, crucified savers on a cross of zero interest rates and fueled a global commodity bubble that erodes Main Street living standards through rising food and energy prices — a form of inflation that the Fed fecklessly disregards in calculating inflation.

These policies have brought America to an end-stage metastasis. The way out would be so radical it can’t happen. It would necessitate a sweeping divorce of the state and the market economy. It would require a renunciation of crony capitalism and its first cousin: Keynesian economics in all its forms. The state would need to get out of the business of imperial hubris, economic uplift and social insurance and shift its focus to managing and financing an effective, affordable, means-tested safety net.

— Posted by Tracy Bloom.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.