Apple Bullies the U.S. Government for Lower Taxes

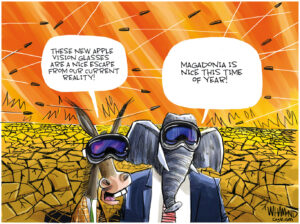

Apple CEO Tim Cook threatened Tuesday to keep more than $100 billion of the company's international earnings away from the United States unless Congress dropped the 35 percent corporate tax rate to the single digits.

Apple CEO Tim Cook threatened to keep more than $100 billion of the company’s international earnings away from the United States unless Congress dropped the 35 percent corporate tax rate to the single digits.

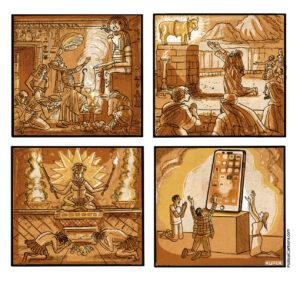

This bold demonstration of corporate defiance comes after Apple acknowledged sheltering at least $30 billion of overseas profits in Irish subsidiaries that pay no more than 2 percent in taxes.

Cook shrugged off criticism from a Senate subcommittee Tuesday about Apple’s tax avoidance moves, saying the company was acting “in the letter and the spirit of the law.”

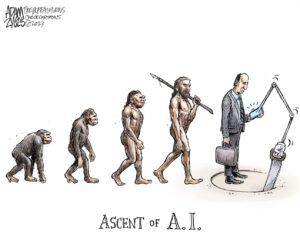

Edward Kleinbard, a professor at USC Gould School of Law, said that Apple is not alone in its effort to earn “stateless income,” profits that are not subject to taxation by any country. Nothing is preventing other big technology companies, such as Amazon, Microsoft and Google, from doing the same.

Corporate tax expert Jennifer Blouin of the University of Pennsylvania’s Wharton business school said the revelations were “extraordinary but not surprising.”

“We have seen versions of this with Microsoft and with Google,” she said. “I hope it gooses the notion that we need to fix the worldwide system.” She said the current law was written before huge profits were possible.

“I have worked in this area for years and it’s been largely an obscurity. But it’s at the forefront now, and it needs to get fixed.”

— Posted by Alexander Reed Kelly.

Your support matters…The Guardian:

Three subsidiaries based in Ireland are also used to shelter profits made in the rest of Europe and Asia but are not classed as resident in any country for tax purposes – a tactic dubbed the “iCompany” by critics.

Cook’s testimony to a Senate sub-committee investigating multinational tax practices largely confirmed its findings that Apple had taken tax avoidance to a new extreme by structuring these companies so they did not incur tax liabilities anywhere.

Phillip Bullock, the California company’s head of tax, estimated that just one of these subsidiaries – Apple Operations International – had channelled $30bn in global profits over the last five years without filing a single income tax return.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.