Americans with Health Insurance Still Can’t Afford Many Treatments

Meanwhile, health insurance CEOs pocket millions, much of it in stock and stock options. Image: Adobe

Image: Adobe

Last year was a grim one for people in California and elsewhere who needed to see a doctor. According to Gallup, nearly four in 10 Americans said they or a family member postponed medical treatment in 2022 because of the cost.

That figure, 38%, was far and away the highest in the 22 years that the global analytics firm has been polling on the question. It was up 12 points over the year before. But Gallup’s consumer feedback really cut to the bone when it got specific: More than a quarter of the postponed treatments were for a “very” or “somewhat” serious condition. And poor people, young people and women were the most likely to report delaying care.

Last year was also notable for an analysis by the Kaiser Family Foundation that estimated 23 million Americans, nearly one in 10 adults, owed significant medical debt of $250 or more. About 3 million people owe between $5,000 and $10,000, and 3 million more have debt in excess of $10,000, KFF found, using data as of December 2019 — before the pandemic and the most current inflationary cycle thrust many workers and families to the brink of financial ruin.

Add it up, and it isn’t surprising that a substantial number of people postpone care until they are at emergency status — and even then, it’ll cost. Last year, a single person who bought health insurance on the Affordable Care Act marketplace faced an out-of-pocket maximum of $8,700; for a family, that total leaped to $17,400. Both limits were raised again this year.

These top health insurance execs get a little of their compensation in salary and a lot of it in stock or stock options.

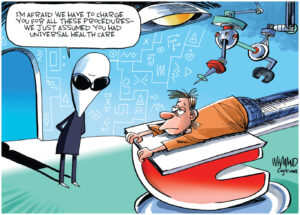

But it wasn’t all bad — if you ran a health insurance giant.

In fact, 2022 was a record year for the CEOs of the seven major publicly traded health insurance and service conglomerates. They raked in more than $335 million in collective compensation, according to the health site STAT. That total represented an 18% jump over the previous record, which, perhaps unsurprisingly, had been set the year before.

Leading the pack was Joseph Zubretsky, CEO of Molina Healthcare, whose total compensation hit $181 million. But the top executives at the six other behemoths — Cigna, CVS Health (which owns Aetna), Humana, Elevance Health (formerly Anthem), UnitedHealth Group and Centene — didn’t exactly struggle: Only one of them, Sarah London at Centene, made less than $23.8 million.

Wendell Potter, a former Cigna vice president turned whistleblower who has written extensively on the topic of health insurers’ profits and executive pay, noted that he finds STAT’s reporting the most accurate because it calculates the pay packages “in a way that reflects how much the executives gained on their long-held stock.”

That’s a key point. These top health insurance execs get a little of their compensation in salary and a lot of it in stock or stock options. They’re paid to drive the price upward — and as that happens, they’re able to cash in on previous stock awards or simply continue to hold them and ride the crest of the wave.

We know the figures only because the Securities and Exchange Commission requires such publicly owned companies to disclose them. For systems like Kaiser Permanente that claim nonprofit status, the numbers can be more difficult to ascertain, although the late Kaiser CEO Bernard Tyson was reported to have been compensated roughly $18 million five years ago.

Either way, running a company that sells health insurance is a great gig. It’s an even better setup when that company becomes involved in almost every facet of health care delivery, not just processing premiums and paying out claims.

The health care conglomerates have continued to grind out spectacular results straight through the pandemic. In the early days of COVID-19, insurers reaped windfall profits as people kept paying their premiums but stayed away from hospitals and clinics — but the companies warned that tougher times were ahead, once lockdowns were lifted and people began filing in to receive the care they’d postponed.

Instead, the ensuing years have been financial whoppers. UnitedHealth, for example, made $15.4 billion in 2020, $17.3 billion in 2021 and $20.6 billion last year. That’s net revenue — profit. Cigna rolled to $6.7 billion in profit in 2022, with Elevance right behind at $6 billion.

How? Diversification. CVS Health certainly sells health insurance through its Aetna division, but it also controls the largest chunk of America’s pharmacy business. This year the company closed a $10.6 billion deal to buy Oak Street Health, which operates 169 medical centers across the U.S. that focus on highly profitable screening and diagnostic services for older adults.

Such vertical integration — not only charging health care premiums but also investing in medical groups, home health, pharmacy, technology and the like — is common among these companies. To call them insurers is to drastically understate the scope of their power.

The giant health companies are still in the insurance business, but that’s only part of the story.

The firms also have their eyes fixed on the government’s kitty. One reason Joe Zubretsky received $181 million in compensation from Molina is that the health insurer has enjoyed a massive windfall by being heavily involved in both Medicare and, especially, Medicaid.

According to STAT, more than 80% of Molina’s revenue now comes from the Medicaid federal insurance program.

The firm has plenty of company. Five major for-profit players — Centene, Elevance, UnitedHealth, Molina and CVS Health — control more than half of the nation’s managed-care operations market for Medicaid plans. The Golden State alone is worth the effort: A finalized contract announced by the state of California earlier this year set up Molina to double its annual Medi-Cal premium revenue to nearly $4 billion via new enrollees.

The giant health companies are still in the insurance business, but that’s only part of the story. They’re now into almost every aspect of health care — so long as it turns profit. Meanwhile, the average family health plan premium last year was $22,463.

“Keep all of this in mind the next time you go to the pharmacy counter and are told that even with insurance you’ll have to pay a king’s ransom for your meds, because your insurer — through its pharmacy benefit manager — has once again jacked up your out-of-pocket requirement,” Wendell Potter wrote in June. It’s a good time to be a health insurance CEO — and a lousy time to need care.

Copyright Capital & Main.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.