Apple Tete-a-Tete With Twitter (Update)

In the race to build the most widely used and technologically redundant social network out there, Apple has considered investing hundreds of millions of dollars in Twitter. (Or not.)

Update:

This story has been disputed. Earlier post follows.

***

In the race to build the most widely used and technologically redundant social network out there, Apple has considered investing hundreds of millions of dollars in Twitter.

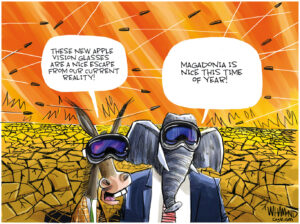

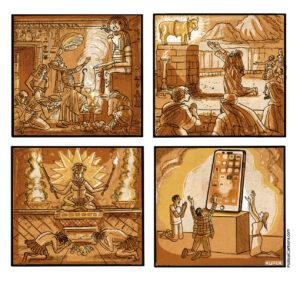

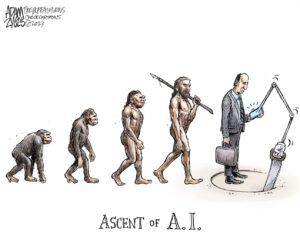

How many social networks do computer users need? One for music, one for photos, one for food and another for all purposes. Think of the tremendous amount of money — billions of dollars — and human effort that has gone into building technology and software that exists in multiple forms under numerous brand names, all so we can be more connected to the world while ignoring each other on the bus, in cafes and at home.

In the last decade, social networking and the industries that have sprung up around it have become primary human fascinations. Companies are betting that their investments will bring big returns, and for that reason, they will continue to pour precious time, money and creative power into the business, no matter how redundant it is.

— Posted by Alexander Reed Kelly.

Your support matters…The New York Times:

Though an investment in Twitter would not be a big financial move for Apple by any stretch — it has $117 billion in liquid investments, and it quietly agreed to buy a mobile security company for $356 million on Friday — it would be one of Mr. Cook’s most important strategic decisions as chief executive. And it would be an uncommon arrangement for Apple, which tends to buy small start-ups that are then absorbed into the company.

But such a deal would give Apple more access to Twitter’s deep understanding of the social Web, and pave the way for closer Twitter integration into Apple’s products.

Twitter has grown quickly, amassing more than 140 million monthly active users who generate a vast stream of short messages about their lives, the news and everything else. An Apple investment would give it the glow of a close relationship with a technology icon, and would instantly bolster its valuation, which, like that of other start-ups, has languished in the wake of Facebook’s lackluster market debut. In fact, word of the talks comes at a time when some are asking whether expectations for the potential of social media companies have gotten out of hand, and shares of Facebook, Zynga and other companies have wilted.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.