Is JPMorgan Chase About to Buy Its Way Out of Another Prosecution?

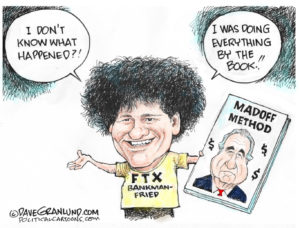

On the heels of an anticipated $13 billion fine to make its responsibility go away in the mortgage meltdown, the storied bank reportedly is in talks for a “deferred prosecution agreement” over its handling of some of Bernie Madoff’s Ponzi money. Short version: Pay a fine, and the bank avoids criminal charges. So in addition to being "too big to fail," now we have "too big to be guilty."

Federal prosecutors reportedly are discussing a deal with beleaguered JPMorgan Chase that would allow the bank to pay a fine to get out from under possible criminal charges tied to its handling of epic swindler Bernie Madoff’s bank accounts, according to The New York Times on Wednesday.

These are some of the same bankers who Madoff once said “had to know” that he was perpetrating the largest Ponzi scheme — $17 billion in lost assets, $64 billion in paper losses — in history. The government’s thinking, according to the Times, is that to pursue criminal charges against the bank could destabilize the economy, and lead to industry job losses.

The actual repercussions would depend on the underlying criminal charge. The most serious potential violation could complicate JPMorgan’s business with certain clients, possibly forcing investors like pension funds to withdraw some money from the bank. But a lesser violation would be likely to have more of a reputational consequence.

For the government, it would represent an extraordinarily rare show of force. Ever since a criminal indictment led to the demise of the accounting firm Arthur Andersen, Enron’s auditor, the government has been wary of imposing criminal charges on big corporations for fear that it would imperil the institution and have ripple effects on the broader economy. Under federal guidelines, prosecutors must weigh “collateral consequences,” like job losses and economic implications, in such an action.

HSBC, for example, paid $1.9 billion to settle a money-laundering case, but the Justice Department stopped short of indicting the British bank. The case reinforced concerns that big banks, having grown so large and interconnected, are too big to indict.

As Robert Scheer pointed out the other day, taking away a relatively small stack of JPMorgan’s profits isn’t a particularly effective deterrent. And no one seems to be considering the impact on consumer confidence in the financial system when banks routinely get passes for egregious behavior. That JPMorgan Chase’s stock price has gone up despite the revelations and accusations of wrongdoing suggests that investors, at least, are betting the bad boys of Wall Street will survive regulators who seem more interested in protecting banks than punishing them.

One of JPMorgan’s more dogged pursuers is Irving H. Picard, the trustee trying to recover as much of the lost Madoff assets as possible for the victims, and who filed a $6.4 billion lawsuit against JPMorgan over its role as Madoff’s banker. Some of the evidence that has surfaced in that case is pretty compelling, as related by the Times. Emails reveal some at the bank thought Madoff should be investigated — an effort consisted of “a phone call with Mr. Madoff” and “a Google search with no follow-up.”

Similar concerns were enough to deter JPMorgan’s own private bank from doing business with Mr. Madoff. In an e-mail, a JPMorgan wealth management executive remarked that Mr. Madoff’s “Oz-like signals” were “too difficult to ignore.”

After Mr. Madoff’s arrest in December 2008, Mr. Picard said, a flurry of JPMorgan e-mails captured the lack of surprise at the bank.

One employee, referring to the agenda for the June 2007 meeting, wrote, “Perhaps best this never sees the light of day again!!”

—Posted by Scott Martelle

.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.