Tax Move Would Let Churches Endorse or Oppose Candidates

Some in Congress hope to drop a 1950s-era amendment from the final tax bill and allow nonprofits to engage in political activity without losing tax-exempt status. President Trump at February's National Prayer Breakfast, where he expressed his intention to do away with the Johnson Amendment. (Mark Wilson / Getty Images)

President Trump at February's National Prayer Breakfast, where he expressed his intention to do away with the Johnson Amendment. (Mark Wilson / Getty Images)

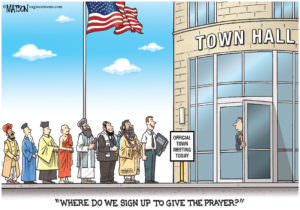

Some lawmakers are hoping to repeal a provision in the U.S. tax code that prohibits tax-exempt churches and nonprofit groups from taking a stand on political candidates. Currently, the House version of the tax bill moving through Congress includes language repealing the Johnson Amendment, but the Senate version does not.

Named after then-U.S. Sen. Lyndon Johnson, the amendment was adopted by Congress as part of tax reform in 1954.

According to Nonprofit Quarterly:

Today’s news is that the repeal language written into the version of tax reform passed by the House last month was not included in the Senate version passed after midnight last Friday by a vote of 51–49. All Democrats voted against the Senate bill; Sen. Bob Corker (R-TN) was the only GOP senator to vote “no,” citing concerns about congressional Joint Committee on Taxation estimates that forecast the measure increasing the national debt by $1 trillion over ten years, after accounting for increased economic activity. The most likely scenario moving forward is that the differing House and Senate measures will have to be reconciled before the measure can be sent to the President for his signature.

Democratic supporters of the Johnson Amendment have voiced concerns that repeal would blur the line separating church and state and could open the door to tax-exempt religious institutions funding political candidates. Repealing the amendment is a cause typically taken up by evangelical churches and conservative political candidates who believe it violates free speech rights. Ohio’s Republican Rep. Jim Renacci told The Associated Press, “I believe that churches have a right of free speech and an opportunity to talk about positions and issues that are relevant to their faith.”

In February, Trump promised to do away with the Johnson Amendment through his executive powers:

He then signed an executive order in May that fell short of this goal, though it did make it easier for churches and nonprofits to participate in political dialogue without giving up their tax-exempt status. Called the Presidential Executive Order Promoting Free Speech and Religious Liberty, the order asks the IRS not to take action against churches that speak “about moral or political issues from a religious perspective, where speech of similar character has, consistent with law, not ordinarily been treated as participation or intervention in a political campaign on behalf of (or in opposition to) a candidate for public office”—meaning that churches can speak on political issues as long as they do not explicitly endorse or oppose candidates.

Leading the current repeal efforts in the Senate are Sens. Orrin Hatch, R-Utah, and James Lankford, R-Okla.

“We feel very good about protecting the free speech rights of every American regardless of their faith, for profit, nonprofit status, whatever it may be, we feel like this is going to be the opportunity to repair this,” Lankford told CBN News, a Christian news site.

The House-passed version of the tax bill, officially known as HR-1, can be found here, and the Senate version here.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.