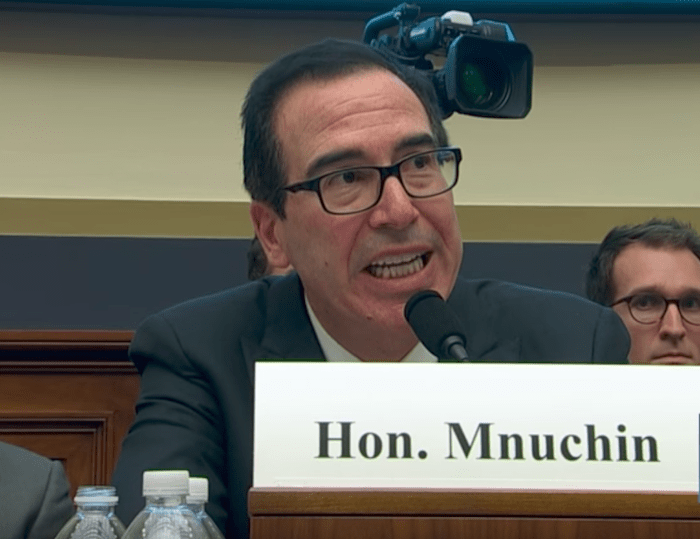

Bankruptcy Lawyer Fires Back at Steven Mnuchin’s ‘Robo-Signing’ Claims

The lawyer, a Republican and Trump supporter, asks Mnuchin to recognize the damage done by big banks. Screen shot via CSPAN

Screen shot via CSPAN

Steve Mnuchin may have been confirmed as President Trump’s Treasury Secretary, but he’s still facing pushback from his colleagues in Congress. During a hearing of the House Financial Services Committee, Rep. Keith Ellison sparred with Mnuchin over his past work at OneWest, a bank that’s been labeled a “Foreclosure Machine.”

The argument occurred when Ellison brought up the financial term “robo-signing,” in reference to Erica Johnson-Seck, a OneWest’s vice president for bankruptcy and foreclosure who notoriously robo-signed countless OneWest documents. (“Robo-signing,” as explained by Wikipedia, is “a term used by consumer advocates to describe the robotic process of the mass production of false and forged execution of mortgage assignments, satisfactions, affidavits, and other legal documents related to mortgage foreclosures and legal matters being created by persons without knowledge of the facts being attested to.”)

“Do you even know what Robo-signing is?” Mnuchin asked Ellison, before spending several more minutes laying in to the Minnesota Democrat.

Linda Tirelli, a bankruptcy attorney in White Plains, N.Y., certainly knows “what robo-signing is,” and she took the time to respond to Mnuchin in a letter published on the Huffington Post:

Secretary Munchin: I do know what robo-signing is and while you don’t think it’s a “legal” term all you need to do is enter the term “robo-signer” into a search engine and, lo and behold, discover it’s a widely used and accepted term found in legal documents, deposition transcripts, and judicial opinions throughout the country. I’ve spent the last ten years of my legal career calling out the systemic fraud that is robo-signing; a practice that’s been adopted as a “business as usual model” by the largest financial institutions in our country. Just for fun, Secretary Munchin, please Google “Linda Tirelli robo signer” and you’ll find no less than eight hundred and forty hits highlighting my work as a consumer advocate exposing the fraud that is robo-signing and document fabrication. Next: Google “Steven Mnuchin robo signer” and you’ll come up with nearly the same number of results; essentially, pointing out your rationalizing the practice. Some background: falsified documents are routinely robo-signed by low-income wage earners trying to make ends meet. In depositions (I dare you to ask me for transcripts) they freely admit that they aren’t the person whose name is on the document, be it the VP of CitiBank, Bank of America, Wells Fargo,Chase or any other financial institution, Many admit to signing or notarizing hundreds of documents per day. In one case involving Bank of America I discovered three robo-signed documents purporting to assign a homeowners note and mortgage and it was signed by the same person, David Perez, on the same day, in front of the same notary; with the signatory claiming to be a Vice-President with authority to sign as an agent for three different banks. In fact — not mentioned in any of these assignments — he was working for just one bank: the aforementioned Bank of America.

I was also instrumental in uncovering the Wells Fargo Attorney Foreclosure manual. Have you read it Secretary Mnuchin? I’ve got twelve different editions if you’re interested and only one has been made public. It isn’t very long but it reads like a blueprint for fraud. There’s no provision in this manual that allows Wells Fargo lawyers to admit any wrong-doing no matter how legally defective they find the documentation to be. The manual simply white washes any notion that Wells Fargo may not have the right to enforce a mortgage lien or foreclose on a property. I no longer count how many cases I see involving fraud against unsuspecting homeowners. Just to remind myself that it’s a fraudulent document I’m reading, I went on-line and for $9.99 and bought my own rubber stamp (with a red-ink pad). What does it say? “WTF!” in big letters. Now, before you dismiss me as a fanatic Hillary supporter, let me disabuse you of that notion. I don’t wear pussy-hat caps nor Birkenstocks and I don’t scarf down granola. I’m not a bleeding heart liberal. I’m a well educated lawyer and successful business owner who is also a registered Republican and Trump supporter. I call it like I see it and as I see it the Mega-Banks and servicers sold out and gave up any semblance of integrity. They went down the very wrong path of lies and deception and, in the process, wreaked havoc with Main Street. As a hard working conservative, I come from a place where I acknowledge a problem when I see it, and do whatever I can to fix it. Secretary Mnuchin: pull your head out of the sand and admit the problem of robo-signing exists and persists. Stand up to those who want to give the financial services industry a free pass — like former AG, Eric Holder — allowing them to buy their way out of jail with some “settlement money.” As recent history demonstrates, that does nothing to fix the problem. I encourage you to take a stand and hold the corporate blood sucking thieves accountable. I’m not a proponent of over-regulation because I believe it does hurt smaller local banks and credit unions. However, I do want the sleazy predatory Mega-Banks ― the ones that continue to engage in practices like robo-signing ― to be held accountable and, for Pete’s sake, let’s stop trying to emasculate the one Federal agency that is the consumer’s watch-dog: the Consumer Financial Protection Bureau (CFPB). As far as taking offense at being called a “Foreclosure King?” Grow up. Your July 27th appearance before the House Financial Services Committee made you look like a pompous jerk. Wipe the smirk off your face, roll up your sleeves and go do something to restore Main Street’s confidence in our financial institutions. If you need further input and suggestions I might be able to find some time in my schedule.

Watch the the tense exchange between Mnuchin and Ellison in the video above.

–Posted by Emma Niles.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.