Would Warren Prosecute the Perpetrators of the Great Recession?

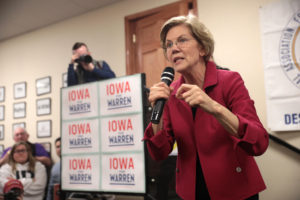

Professor Bill Black examines a pair of recent bills from the Massachusetts senator, and what might happen if they were signed into law. Sen. Elizabeth Warren, D-Mass., answers questions during a presidential forum at Texas State University this week.

Sen. Elizabeth Warren, D-Mass., answers questions during a presidential forum at Texas State University this week.

What follows is a conversation between professor and author Bill Black and Marc Steiner of the Real News Network. Read a transcript of their conversation below or watch the video at the bottom of the post.

MARC STEINER Welcome to The Real News Network. I’m Mark Steiner. Great to have you all with us. Senator Elizabeth Warren is attempting to make waves with her bold pronouncements during her bid for this presidency. She’s introduced two bills into the Senate. The first is called the Corporate Executive Accountability Act, which will hold corporate executives of million-dollar corporations criminally liable for negligence with potential prison time. The other is called The Too Big to Jail Act, creating a corporate crime strike force. In the wake of the 2008 meltdown, where there were no criminal prosecutions of note despite ruining millions of lives in our country, it’s led to a roiling discontent in America. Why has it been so difficult to prosecute bankers and corporate leaders and executives in our country? Why has the government been so reluctant to do so? And in the unlikely circumstance that Warren’s bills will get passed in the Senate, what would be the result and complications if they did? Joining us once again to sort through all of this is a man who knows a thing or two about white-collar crime. Bill Black— Associate Professor of Economics and Law at the University of Missouri-Kansas City, white- collar criminologist, former financial regulator, the author of the book The Best Way to Rob a Bank Is to Own One, and a regular contributor here at The Real News. Bill, welcome back. Good to have you with us. Thank you. So this has obviously been building since 2008. People have been wanting some answer, but I think most folks don’t know really what that means. I’ve been reading a lot of pieces that are pro and con about what Elizabeth Warren is suggesting. Let’s go through what she’s suggesting and get your initial read and analysis of that.

BILL BLACK Okay. So as you said, there are two different acts. She just rolled one of them out a couple of days ago and they fit together. One is addressed more directly to the financial crisis and the other one is prompted by the financial crisis, but broader than it. That second one would propose to change the requirement to get a guilty verdict to a demonstration of negligence on the part of officers when they commit the really serious crimes. The other act would basically provide more resources to go after elite, white-collar criminals.

MARC STEINER In the New York Times, there was a quote from Lanny Breuer who is a Justice Department, Criminal Division official former head. He said on Frontline, “when we can’t prove beyond a reasonable doubt that there was a criminal intent, then we have a constitutional duty not to bring those cases.” And Attorney General Eric Holder told the Senate committee that some banks would become “too big,” that prosecuting them would have negatively affected the economy. In other words, they’ve become too big to jail. And then, in Britain there it was said that if you start prosecuting these people, then it threatens the very foundations of the free enterprise system. So Bill, what’s the problem here?

BILL BLACK So the problem is the people at the top in both the United States and the United Kingdom. For example, Prime Minister Blair complained at a time when the Financial Supervisory Authority— which is referred to over there as the Fundamentally Supine Authority [laughter]— was absolutely not regulating anything, that it was outrageous overregulation, and how dare they treat bankers as potential criminals. We have the combination of Breuer and Holder where the only issue is, which of them was more moronic on this subject, and it was a dead tie.

MARC STEINER So tell me why do you use the word “moronic?”

BILL BLACK Because it’s a family show.

MARC STEINER [laughter]

BILL BLACK So seriously, to go through these things, let’s recall that in much more difficult cases in the savings and loan debacle, we oriented the prosecutions entirely towards the most elite defendants. And here’s the first thing: There is never a problem to the financial system from prosecuting individual criminals. It is not good for a financial system to be run by criminals. You strengthen the financial system when you convict and remove criminals from running the largest bank. [laugher]

MARC STEINER Let me just ask you a question about that. But is the nature of the competition among banks and the competition to make as much money as humanly possible— like the scandal that happened in 2008 that tanked our economy for a while and put millions of people into huge financial jeopardy— that seems to me to be the daily workings of those institutions. And the issue…

BILL BLACK No, no.

MARC STEINER Go ahead. Tell me why you say no.

BILL BLACK Banks don’t do anything.

MARC STEINER The people in them do, though.

BILL BLACK The bankers do things and bankers shape the institutions, so institutions matter enormously. And that’s the first big thing in a critique of Senator Warren. If anybody is close to Senator Warren, please send her this link. [laughter] We can really help. She’s got exactly the right ideas, but she isn’t an expert in criminology. She wasn’t part of the efforts to prosecute folks successfully that I’m about to describe. We can really, really help her be effective and we’re willing to help any candidate be effective on these issues. Two enormous institutional changes have made the world vastly more criminogenic. Those changes are: we got rid of true partnerships where you had joint and several liability. Therefore, it really paid to make sure that you didn’t make a partner, someone who was super sleazy, because then they could sue you— not them, not the sleazy partner, but you and it was absolutely no defense that you had nothing to do with it. Your entire net worth could be taken. That’s what a true partnership was. We got rid of true partnerships throughout the financial world. The second thing is modern executive compensation. Modern executive compensation not only creates the incentives to defraud, because you can be made wealthy. It provides the means to defraud. This allows you to convert corporate assets to your own personal wealth in a way that has very little risk of prosecution and it allowed you to suborn the controls but also [allowed] the lower officers and employees to actually commit the fraudulent acts, which are usually accounting for you in a way that you’d have plausible deniability. We can change both and we must change both of those incredibly perverse incentives if we want to deal with fraud successfully. So that’s the missing part of her plan and I think she would agree with everything I’ve said. Now we have a detailed plan— we being the bank whistleblowers united— that we put out two years ago in the election, two and a half years ago. We’ll put this on the website, or at least the links to it for folks who want to know the kind of institutional steps you need to start changing this. But even with what I’ve said about this much more criminogenic environment, it remains true that we could have prosecuted successfully elite officers and every one of the major participants that committed these frauds. Indeed in many ways it would have been easier than during the savings and loan debacle, because unlike the savings and loan debacle, we have superb whistleblowers— literally hundreds of whistleblowers who can say explicitly that these frauds occurred. And then we do it the old-fashioned way. That would give us the ability to prosecute midlevel officials and we can take it up the food chain by flipping them so that they give us information on the more senior folks. In some cases, our whistleblowers were right there in the C-suite and that would have included for example, a dead to rights prosecution against Robert Rubin. That’s as senior as you can get at city, a dead to right prosecution of Mozilo at Countrywide. And we have other institutions like Wells Fargo where the following happened, so it’s easy to look at liar’s loans. Liar’s loans again had a fraud incidence of 90 percent— nine-zero. So the only entities doing liar’s loans as a significant product are fraudulent. Similarly, if they’re doing appraisal fraud, extorting appraisers to inflate appraisals, that only occurs at fraudulent shops. So Wells actually checked and it’s easy to check and that’s an important point. The fact that the Department of Justice never did this, and the banking agencies never did this, is a demonstration that they didn’t want to actually conduct investigations. Here’s how you check: so in a liar’s loan, you don’t verify the borrower’s income, but the borrower signs at the same time a permission that says you can check this against my I.R.S. forms. And here’s a hint: none of us deliberately inflate our income on our income tax returns because we’d have to pay more taxes. [laughter] So in the case of both Countrywide and Wells Fargo, we know that senior management who was given the results said, these kinds of loans, liar’s loans, are majority frauds. And we know that senior management in both cases said, you know what we should do? Many, many more of those. That is a great criminal case. At J.P. Morgan, we have a great criminal case.

MARC STEINER Let me just interrupt you for a second, Bill. I want people to understand this because everything you’re reading in the press right now, almost every article, whether they seem to like what Elizabeth Warren is suggesting, or oppose it, have questions about it. Almost everybody to a person I’ve read has said, it’s almost impossible to prosecute these cases. We don’t have a law to do it, that prosecuting somebody for, as she’s suggesting, for negligence would not get the job done even if her bill ever passed. And so, talk a bit about that though. I’m very curious since clearly, you’re going against the common wisdom that most people would have and anything they read— whether it’s The New York Times or anywhere else— that we don’t have the laws to make prosecutions work, which is one of the reasons why we’re not prosecuting people.

BILL BLACK Okay so everybody you’ve read, has never been involved in these successful prosecutions.

MARC STEINER No, but if they’re journalists and they’ve studied it, they should know what they’re talking about.

BILL BLACK Seriously? [laughter]

MARC STEINER You would think, right? Well I would hope so. Anyway, but go ahead. [laughter].

BILL BLACK No, I would not think so. I don’t think that at all because otherwise, they would have talked to people like us who actually did it. So let’s go back. Under the same laws in the savings and loan debacle, we were able to hyper-prioritized prosecutions against the most elite folks. So we’re going after folks in the C-Suite— the C.E.O.s, the chief operating officers, the boards of directors, and such. We got over a thousand convictions in these cases, just the ones designated as major. We did over 600 prosecutions of the most elite of the elite, against the best criminal defense lawyers in the world with the same laws, and we got over a ninety percent conviction rate. So can it be done? Of course it can be done. We’ve shown that it can be done. Maybe our cases were just simple because it was just savings and loans and these are big banks. Actually, the prosecutions in many of these cases were easier. The loans in the savings and loan debacle, were actually much more complicated than home loans. They were commercial construction loans, $80-90 million dollars at-a-pop often. That’s far more complex to explain to a jury, than a home loan and something as easy as a liar’s loan and extorting an appraiser. In addition, there are massively more whistleblowers. I cannot remember the name of a significant whistleblower in the savings and loan debacle that was critical to prosecutions. I’m sure there were a couple, but again we have literally hundreds of whistleblowers who came forward in this crisis. This crisis occurred because first the Bush administration and then the Obama administration, were unwilling to investigate, unwilling to prosecute. And here’s again the key. There are about two F.B.I. white-collar specialists per industry in the United States— not per firm, per industry. So that means they don’t have expertise in individual industries and they don’t walk a beat, or they’d never find it. They only come when there’s a criminal referral. Our agency, our much tinier agency back in the savings and loan debacle, made over thirty thousand criminal referrals. All of the federal banking regulatory agencies, much bigger in the great financial crisis, made fewer than a dozen criminal referrals, 30,000 to under a dozen. That means that the banking regulatory agencies basically ceased functioning in terms of criminal referrals. And why? That’s the third big change and the third big change is ideological. What you saw is, both under the Republicans and under Bill Clinton— the Democratic Party, the due Democrats, the Wall Street wing of the party— they were simply unwilling to even think of bankers as criminals. I got out of the regulatory ranks when under Bill Clinton we were ordered, and I witnessed personally, to refer to the industry as our customers. Not the American people as our customers, the industry as our customers. Well do you make criminal referrals on your customers?

MARC STEINER So we’re here talking to Bill Black and we’ve been covering some of the history of this. What we are going to do is we’re going to take a break here and come back with another segment shortly and really probe into what Elizabeth Warren has said she wants to make into law. Would that make a difference? Does it fall short and it could lead to more prosecutions? We’re going to come back to that. So you want to hit the next segment with Bill Black and Marc Steiner. Bill, thank you once again for being with The Real News. It’s always a pleasure to have you with us.

BILL BLACK Thank you.

MARC STEINER And I’m Mark Steiner here for The Real News Network. Take care.

Your support matters…

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.