Warren Slams Wall Street ‘Vampires’ in New Economic Plan

The Massachusetts senator and Democratic presidential contender wants to make it harder for big banks to prey on consumers. Democratic presidential candidate Sen. Elizabeth Warren, D-Mass. (Michael Wyke / AP)

Democratic presidential candidate Sen. Elizabeth Warren, D-Mass. (Michael Wyke / AP)

In the runup to the 2020 Democratic presidential primary, Massachusetts Sen. Elizabeth Warren has released her vision for tackling college debt, reducing the cost of child care and reforming immigration, but her latest plan involves the issue that first brought her to national prominence: Wall Street.

In a post published Thursday on Medium, Warren calls for the reinstatement of the Glass-Steagall Act, a Depression-era law separating commercial banks from their investment divisions, thereby preventing banks from using consumer deposits for risky investments.

The law was partially repealed in 1999, which, as a 2015 NPR analysis explained, “opened the floodgates for giant mergers” and allowed commercial banks to engage in such previously banned activities as investments and insurance.

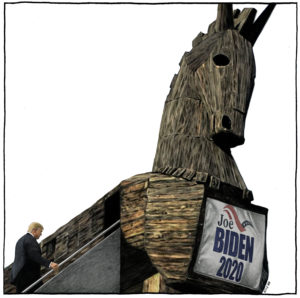

Warren calls her latest proposal part of her “economic patriotism agenda,” which, in addition to reinstating Glass-Steagall, includes plans for postal banking and reining in executive compensation by tying pay to companies’ performance, and new rules for private equity firms, which make money by buying failing companies, restructuring (often by cutting budgets and laying off workers), and then reselling the companies for a profit.

“Sometimes the companies do well,” Warren notes. “But far too often, the private equity firms are like vampires—bleeding the company dry and walking away enriched even as the company succumbs.”

CNN called Warren’s new proposal “red meat for the Democratic Party’s liberal base, which has zeroed in on Wall Street speculation as a root cause of growing economic inequality.”

But Drew Maloney, president and CEO of the American Investment Council, a group representing the private equity industry, sees the proposal as harmful. “Extreme political plans only hurt workers, investment, and our economy,” he told CNN, adding that “[p]rivate equity is an engine for American growth and innovation—especially in Senator Warren’s home state of Massachusetts.”

Warren has long championed constraining Wall Street. “In the lead-up to the 2008 crisis,” even before she was a senator, she writes, “I rang the alarm bell as I saw the same tricks and traps emerging in mortgages.”

She continues: “And after I proposed a new federal agency to protect consumers—and President Obama signed that agency into law in 2010—I spent nearly a year setting up the new Consumer Financial Protection Bureau and helping write new rules to crack down on financial scams.”

During the last Democratic presidential primary, Warren pushed candidates to include a repeal of Glass-Steagall in their policy platforms. As CNN reported at the time, in a 2015 email, she warned supporters, “Wall Street spent decades—and millions of dollars—to repeal the original Glass-Steagall Act, and you can bet they’ll do whatever it takes to keep it from being reinstated. … We need grassroots support from all across the country if we’re going to fight back to make our financial institutions smaller and safer.”

Read Warren’s latest proposal here.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.