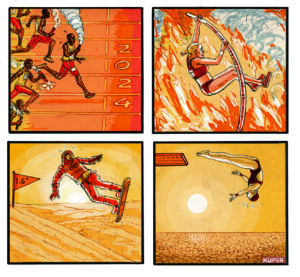

Wall Street Drives Racial and Gender Inequality

Those pocketing big bank bonuses are mainly white and male, while those stuck with stagnating wages are mostly women and people of color. Drongowski (CC BY 2.0)

Drongowski (CC BY 2.0)

The people who sell fancy sports cars and high-end Swiss watches look forward to the time of year when the big Wall Street banks hand out their annual cash bonuses.

According to new figures, those bonuses added up a whopping $27.5 billion last year. That’s a lot of Rolexes.

Unfortunately, this huge payout also means the reckless bonus culture that crashed our economy in 2008 is still flourishing.

And there’s another reason we should be disturbed: These Wall Street payouts drive racial and gender inequality.

That’s because the people pocketing Wall Street bonuses are overwhelmingly white and male, while the people stuck with stagnating wages at the bottom of the pay scale are disproportionately women and people of color.

A new Institute for Policy Studies report I co-authored found that if the minimum wage had increased at the same rate as the average Wall Street bonus since 1985, it would be worth $33 today, instead of just $7.25.

Women make up 63 percent of those minimum wage workers, but as little as 20 percent of senior executives and managers at big investment banks like Morgan Stanley and Goldman Sachs.

The share of top executives who are white is even higher — around 84 percent at JPMorgan Chase and Bank of America.

Need I even mention that every single CEO at the top five banks is a white guy?

Reining in Wall Street pay would make our economy more equitable and secure.

In 2010, Congress recognized that fat banker bonuses had encouraged the high-risk behavior that caused the 2008 crash, costing millions of Americans their homes and livelihoods.

As part of a broad financial reform, lawmakers adopted new restrictions on Wall Street bonuses and ordered regulators to implement these rules within nine months. Instead, regulators bowed to pressure from powerful Wall Street lobbyists and never put the law into force.

Meanwhile, members of Congress have been dragging their feet on raising the federal minimum wage. Low-wage workers haven’t gotten a raise for nearly a decade.

Let’s face it: For too long, Wall Street has had too much power in Washington while advocates for the working poor have had too little.

If you’re in the business of selling yachts or Ferraris, the Wall Street bonus bonanza might be a good thing. For the rest of us, not so much.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.