Truthdiggers of the Week: Leaders of the Debt Collective

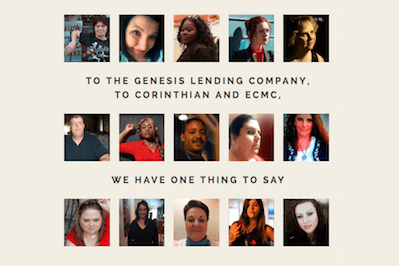

With outstanding student debt in the U.S. topping $1.3 trillion, 15 former Corinthian Colleges students are refusing to pay the onerous, exorbitant cost of a shoddy education. Portraits of the 15 founding members of the Debt Collective. (The Debt Collective)

Portraits of the 15 founding members of the Debt Collective. (The Debt Collective)

Every week the Truthdig editorial staff selects a Truthdigger of the Week, a group or person worthy of recognition for speaking truth to power, breaking the story or blowing the whistle. It is not a lifetime achievement award. Rather, we’re looking for newsmakers whose actions in a given week are worth celebrating. * * *

If you owe the bank a thousand dollars, the bank owns you. If you owe the bank a trillion dollars, you own the bank. Together, we own the bank.

—The Debt Collective

By some estimates, outstanding educational debt among former student borrowers in the United States recently exceeded $1.3 trillion. According to the Pew Research Center, 37 percent of young households held these debts in 2010 at a median amount of $13,000. That’s up from 22 percent nearly 10 years before and from 16 percent in 1989. With—for multiple reasons—the wages of many borrowers too small to provide more than bare survival, some experts see in this upward trend the makings of a new, nationally menacing financial crisis.

Reminiscent of the many homeowners who collapsed into bankruptcy under the weight of unpayable mortgages well before the 2008 financial crisis, many graduates are watching their life prospects shrink and their standard of living decline as too-large chunks of their monthly pay go to banks and financial institutions holding individual obligations that run into the tens of thousands and sometimes hundreds of thousands of dollars. As of fall 2014, 13.7 percent of them were defaulting. Absent the means to increase their income—and few of these appear on the national horizon—borrowers are made into sitting ducks on a banker’s hunting holiday.

But some aren’t staying quiet. On Feb. 23, 15 former students of Corinthian Colleges—one of the largest “higher education” corporations until a flurry of lawsuits and investigations into charges of fraud forced it to start shutting down or surrendering its roughly 100 subsidiaries last year, including Everest, Heald and WyoTech—announced that they would go on “debt strike.” An iteration of Occupy Wall Street’s “Strike Debt,” members of “the Debt Collective” make up a tiny fraction of the more than 100,000 students who attended Corinthian’s schools. (Many of those were veterans of the wars in the Middle East recruited by the schools because veterans receive federal funding.) In the courts and elsewhere, they accuse the business of generally selling an education that was much worse than advertised and, more specifically, “falsely inflating its job placement statistics,” issuing credits that are not accepted at more-traditional schools, making their degrees worthless in the pursuit of further accreditation, and other charges. Some say they are laughed at when they tell people where they went to college.

They write in their manifesto:

Every month, we are forced into debt for basic necessities. We have no choice but to enter into contracts under unfair terms. We have little power to bargain or negotiate.

Creditors are holding us hostage. When we can’t meet the terms of the contract, we are harassed, we have our wages garnished, and some of us are even imprisoned.

The goal of the Debt Collective is to fight back and transform the way we finance basic necessities, such as education, health care, and housing.

The strikers are risking a lot for themselves. Credit agencies will lower their credit scores upon learning they don’t intend to repay their loans. Asked whether he was worried about the consequences of striking, one participant responded: “They’ve already screwed up my credit. There’s nothing worse that they can do to my credit. I’m absolutely not going to be able to afford to buy a house, I can barely afford the car that I have, so what’s the point in not going on strike?” Low credit scores could also prevent them from renting a home or apartment and finding a job, and they risk having their wages garnished.

For people who already feel intensely that they’ve fallen behind in life, the investment of time and energy is enormous. Their civil disobedience alone will not reform the private loan system, but their effort is not necessarily quixotic. They’ve gained the support of Sen. Elizabeth Warren and the Consumer Financial Protection Bureau and may have already succeeded at forcing the Department of Education—the office that handles federal loans, which account for some 89 percent of the $1 trillion-plus total debt—into a position where it may have to act. In December, Warren and other Senate Democrats called on Education Secretary Arne Duncan to “immediately discharge” the loans of at least some former Corinthian students. A spokeswoman said the department “shares the commitment” of the senators “to upholding the rights of students who may have been harmed by the actions of institutions that participate in federal student-aid programs.” Meanwhile, the Consumer Financial Protection Bureau seeks full relief of the privately funded debt owed to Corinthian.

Ann Bowers, a former Corinthian student who is deeply in debt, told The Nation, “I find myself sitting in worse shape than I’ve ever been in my life, because I tried to do better and [do] something good for myself and my family. … And I don’t want to see this happen to future generations.” The 15 brave leaders of the Debt Collective may launch a movement that results in a legal framework that protects people who have no choice but to seek financial help from others. In the hope that they do, they are our Truthdiggers of the Week.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.