Truthdiggers of the Week: 2 Economists Who Challenged an American Myth

Their shocking report shows that higher education does nothing to dissolve income inequality for blacks and Hispanics. Marcus Bain / CC BY-SA 2.0

Marcus Bain / CC BY-SA 2.0

Every week the Truthdig editorial staff selects a Truthdigger of the Week, a group or person worthy of recognition for speaking truth to power, breaking the story or blowing the whistle. It is not a lifetime achievement award. Rather, we’re looking for newsmakers whose actions in a given week are worth celebrating.

I grew up in an immigrant household, and my parents made one thing very clear to me at an early age: You must go to four-year college, because if you do, your life will be better than ours was.

I can’t imagine showing my parents—who are immensely proud that all three of their children are currently pursuing advanced degrees—the results of the jaw-dropping study published by William Emmons and Bryan Noeth at the Federal Reserve Bank of St. Louis in August. The report, which came to my attention this week, is titled “Why Didn’t Higher Education Protect Hispanic and Black Wealth?” It dispels one of the essential myths of the American dream: that pursuing an advanced degree leads to better job opportunities and higher chances of wealth accumulation, no matter one’s race.

Analyzing two decades of data, Emmons and Noeth showed that although a college degree does seem to guarantee higher earnings compared with noncollege-educated counterparts of the same race, the disparities among racial groups are astounding. Imagine my surprise to read that, on average, Hispanic and black college grads held roughly one-tenth of the median family net worth of a white college grad family in 2013. Families headed by white college grads had a median net worth of $359,928, while the net worth of their Hispanic and black counterparts was $49,606 and $32,780, respectively.

These numbers are not only shocking, they’re appalling, and the report only gets more depressing.

Perhaps the most important part of Emmons and Noeth’s study has to do with how minority families fared during the Great Recession, compared with their white and Asian counterparts. It turns out that—due to a number of factors the researchers determined need to be studied further—while holding a four-year degree results in higher incomes for minorities, their average wealth is lower than that of an only slightly educated white. As William Darity Jr., a public policy professor at Duke University, puts it, “a family headed by a black college graduate has less wealth on average than a family headed by a white high school dropout.”

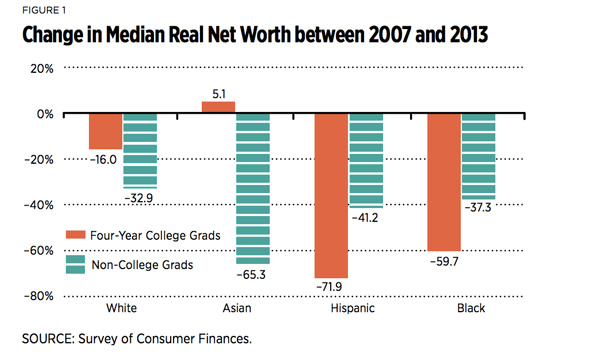

Take a look at the following charts and the explanation offered by the St. Louis Fed researchers:

Figure 1 compares the changes in median wealth between 2007 and 2013 among families headed by four-year college graduates versus those with less education. White and Asian college-headed families generally fared much better than their less-educated counterparts. The typical Hispanic and black college-headed family, on the other hand, lost much more wealth than its less-educated counterpart. Median wealth declined by about 72 percent among Hispanic college-grad families versus a decline of only 41 percent among Hispanic families without a college degree. Among blacks, the declines were 60 percent versus 37 percent.

… Income trends are important in the longer term. College graduates typically accumulate much more wealth over long periods than do those without a college degree. The median wealth among all college graduates increased by 52 percent between 1992 and 2013, while the median wealth among all non-college grads declined by 26 percent. As Figure 4 shows, higher education was strongly associated with greater wealth accumulation among whites and Asians, while a college degree was associated with a much worse wealth trend by a typical Hispanic or black family.

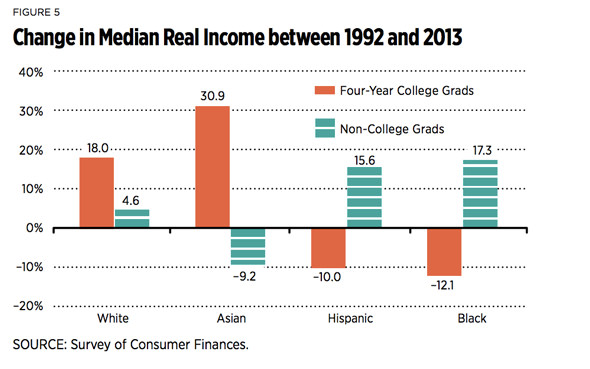

Figure 5 suggests that adverse long-term income trends among Hispanic and black college grads may be an important factor. The median income of college-grad white families grew by 13 percentage points more than their non-college counterparts. The median income of college-grad Asian families grew 31 percent, while the median income of their non-college counterparts fell 9 percent over the same period.

Conversely, median Hispanic and black college-grad incomes fell 10 percent and 12 percent, respectively, while the median incomes of their non-college counterparts rose 16 percent and 17 percent, respectively.

In a New York Times piece, economics writer Patricia Cohen outlines some of the factors that may contribute to the disparity. One of the most important seems to be how minorities invested their money before the recession and their debt-to-income ratios. For example, blacks and Hispanics seem to have placed more of their wealth in houses, while whites and Asians invested in retirement funds. While it’s easy to chalk this up to “financial decision-making,” let’s not forget that subprime mortgage lenders disproportionately targeted minorities.

Job discrimination also played an important role in these statistics. Studies have shown that when nearly identical résumés are submitted, employers tend to favor applicants with white-sounding names. Cohen notes that blacks hold more government jobs than their white counterparts and that these jobs tend to pay them less than what those whites are making. In addition, he finds that blacks and Latinos who hold advanced degrees “are more often in lower-paying fields or graduates of colleges with lesser reputations.” This translates into less ability to save, as well as lower lifetime earnings, according to John Schmitt, a research director at the Washington Center for Equitable Growth.

According to Darity, yet another important factor is that “prior family wealth is the key [since it] shapes both income-generating opportunities and the capacity to allow wealth to grow more wealth.” In other words, wealthier families, which tend to be white or Asian, often provide a safety net for their children—helping with tuition payments and down payments on mortgages, for example. For minority families, whose average wealth is significantly lower, dependence on family wealth is seldom possible.

At a time when income inequality has become one of the most important issues Americans face, it is essential to note how race factors into the wealth gap. The bold, italicized statement at the end of the three-page St. Louis Fed study spells out the stunning truth about racial disparities in family wealth: “Higher education alone cannot level the playing field.”

The numbers in Emmons and Noeth’s study provide clear evidence that racism is systemic and that, sadly, education seems to do little to counter it. For their scholarship and their courage in taking on the myth that higher education creates equal opportunities for Americans regardless of race, William Emmons and Bryan Noeth are our Truthdiggers of the Week.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.