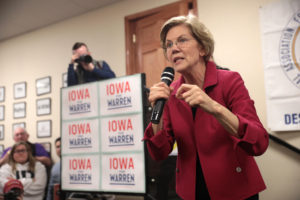

Truthdigger of the Week: Elizabeth Warren

The banking industry and its paid protectors have hounded Elizabeth Warren for the past decade because she is one of the few people in Washington who poses a threat to Wall Street’s control over government.Big bankers and their paid protectors have hounded Elizabeth Warren for a decade because she is one of the few people in Washington who poses a threat to their control over government.

The banking industry and its paid protectors have hounded Elizabeth Warren for the past decade because she is one of the few people in Washington who poses a threat to Wall Street’s control over government.

Warren is the Democratic candidate in the race to represent Massachusetts in the Senate. She is challenging incumbent Republican Scott Brown, who won the seat after Ted Kennedy’s death in 2009 called for a special election. Brown’s victory ended Democratic control of the position dating back to 1953.

In an attempt to scare the Massachusetts electorate into re-electing Brown, New York City Mayor Michael Bloomberg accused Warren of “socialism” in an interview with The New York Times published Oct. 21.

“You can question, in my mind, whether [Warren is] God’s gift to regulation, close the banks and get rid of corporate profits, and we’d all bring socialism back, or the U.S.S.R.”

The charge is typical fare from fiscal conservatives amid the far right backlash that has enveloped politics since President Obama bailed out the banks but failed to protect ordinary Americans from losing their jobs and homes after the 2008 financial crisis. It’s hardly merited though. The kind of regulation that Warren supports and Bloomberg opposes saved capitalism after the stock market imploded in the Great Depression, and kept it functioning with less damage to the American people until President Clinton repealed the Glass-Steagall Act of 1932, permitting banks to make unstable investments and grow to their current, “too big to fail” size.

Warren became a nationally recognized figure during the response to the 2008 crisis, when her longstanding campaign for a new Consumer Financial Protection Bureau gained fresh relevance. Such a bureau, Warren suggested, would represent members of the public in their dealings with banks, credit unions and other financial companies. For many liberals, Warren was the obvious pick to lead the bureau when it was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010. But Obama selected a former Ohio attorney general for the job, suggesting to many observers that he didn’t want to alienate the banks that Warren sought to regulate. She was made a special adviser to the agency instead.

Undeterred, Warren continued her work in the public interest when she announced her candidacy for the U.S. Senate in September 2011. The banking industry immediately began to make huge contributions to Brown, who does not seek the reforms Warren wants. Brown’s re-election campaign had raised $53 million by mid-September.

Warren’s reputation as a public defender is widely recognized. In 1995, while a professor at Harvard Law School and an adviser for the National Bankruptcy Review Commission, she opposed legislation intended to restrict the right of consumers to file for bankruptcy. From 2006 to 2010, she served on the FDIC’s Advisory Committee on Economic Inclusion. Throughout recent years she has been named The Boston Globe’s Bostonian of the Year and was awarded the Lelia J. Robinson Award from the Women’s Bar Association of Massachusetts. Time magazine recognized her as one of the 100 Most Influential People of the World in 2009 and 2010, and The National Law Journal has repeatedly named her one of the 50 Most Influential Women Lawyers in America.

According to economics writer Jeff Madrick, the praise is well deserved. In an article in The New York Times, Madrick said of a book Warren co-authored with her daughter:

“More clearly than anyone else, I think, Ms. Warren and Ms. Tyagi have shown how little attention the nation and our government have paid to the way Americans really live.”

Humble beginnings never guarantee a life spent in service of the underrepresented. But Warren’s career has gone that way. She began her working life as a teenager after a heart attack suffered by her father left her family in dire financial circumstances. She is intimately acquainted with the hardship and loss afflicting much of the public today, and she knows that all Americans need a government that protects their ability to build decent lives. For that reason, and for the words that close this article, we honor Elizabeth Warren as our Truthdigger of the Week.

“There is nobody in this country who got rich on his own — nobody. … You moved your goods to market on the roads the rest of us paid for; you hired workers the rest of us paid to educate; you were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory, and hire someone to protect against this, because of the work the rest of us did. Now look, you built a factory and it turned into something terrific, or a great idea. God bless — keep a big hunk of it. But part of the underlying social contract is, you take a hunk of that and pay forward for the next kid who comes along.” –Elizabeth Warren, September 2011

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.