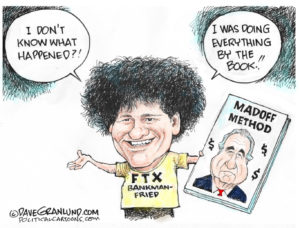

Top Broker Busted for $50B ‘Ponzi Scheme’

Here's yet another candidate for the expanding collection of Tales from the Dark Side of Wall Street (is there any other side?): The Wall Street Journal reported Friday that Bernard L. Madoff, a top trader for nearly five decades who has served as chairman of the Nasdaq Stock Market, was arrested this week after his sons turned him in for engineering an elaborate "Ponzi scheme."

Here’s yet another candidate for the expanding collection of Tales from the Dark Side of Wall Street (is there any other side?): The Wall Street Journal reported Friday that Bernard L. Madoff, a top trader for nearly five decades who has served as chairman of the Nasdaq Stock Market, was arrested this week after his sons turned him in for engineering an elaborate “Ponzi scheme” that, the paper notes, could dwarf the financial debacle that toppled WorldCom in 2002.

Your support matters…The Wall Street Journal:

The Securities and Exchange Commission, in a civil complaint, said it was an ongoing $50 billion swindle, and asked a judge to seize the firm and its assets. “Our complaint alleges a stunning fraud that appears to be of epic proportions,” said Andrew M. Calamari, associate director of enforcement in the SEC’s New York office.

In a separate criminal complaint, Federal Bureau of Investigation agent Theodore Cacioppi said Mr. Madoff’s investment advisory business had “deceived investors by operating a securities business in which he traded and lost investor money, and then paid certain investors purported returns on investment with the principal received from other, different investors, which resulted in losses of approximately billions of dollars.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.