The Tax Hikes That Republicans Love

Rather than close the grossest loopholes and deductions exploited by billionaires, Republican politicians want to punish all those families living large on $300 a week by taxing them more.

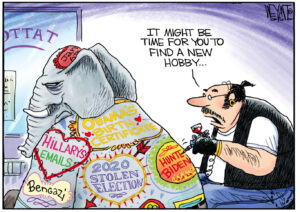

From the tea parties to the corporate boardrooms to the presidential debate platforms, we hear a familiar droning whine about taxes — except the angry message is no longer simply that taxes are too high. Today, conservative politicians and pundits complain instead that some people, namely those too poor to owe federal income taxes, aren’t paying enough. So what if those people can scarcely sustain their families, like the millions of middle-class families doing slightly better but struggling, as well?

This is the Democratic “fairness” argument turned upside down, which may prove to have limited appeal. What will appeal to most Americans even less are the proposed Republican solutions, like a national sales tax. And what might surprise them is that the first president to expand tax relief for the working poor was that almighty Republican icon, Ronald Reagan, whose name is constantly invoked by politicians unworthy of his legacy.

However piously they cite the Gipper as their idol, the Republican candidates for president seem united in their desire to repeal the earned income tax credit, which he justly praised in 1986 as “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress.”

Now, Republican politicians increasingly reject the earned income credit as an immoral form of “welfare,” because its provisions have helped to ensure that roughly 47 percent of Americans pay no federal income tax, with the poorest receiving a modest rebate, instead. That statistic has been distorted all too often into the false assertion, usually uttered on Fox News Channel or right-wing talk radio, that the poorer half of the nation’s population “pays no taxes.”

Of course the working poor pay lots of taxes. In fact, they tend to pay more as a share of their income than the very rich, plenty of whom do not work at all. The poor pay state and local income tax as well as sales taxes, gas taxes and utility taxes, but above all they pay Social Security and Medicare taxes on the very first dollar of income they earn (and on every dollar up to the $106,000 ceiling that shelters the income of higher earners). To suggest that the working poor receive government benefits without paying anything is a brazen lie.

Aside from the earned income credit, there is another very basic reason why the working poor don’t pay income taxes. After decades of falling wages and rising inequality, they literally cannot afford it. As the noted economics reporter David Cay Johnston explained last April 15, the average annual income among the bottom half of American taxpayers was around $15,000. With the first $9,350 exempt from federal income tax for single people, a figure that rises to $18,700 for married couples, millions of households don’t earn enough to owe anything to the IRS.

At the same time, Johnston pointed out that many of the wealthiest families in the country also pay no taxes thanks to loopholes such as the “carried interest” provision, which Republicans fight ferociously to preserve against “socialist” demands that bankers and investors pay the same rate as their secretaries and janitors.

Although polls show that most Americans — including most Republican voters — strongly favor raising rates on the wealthiest taxpayers, the GOP leadership is sworn to prevent any such reform. Rather than close the grossest loopholes and deductions exploited by billionaires, Republican politicians want to punish all those families living large on $300 a week by taxing them more.

One way to do that — favored by House Budget Chairman Paul Ryan, R-Wis, and presidential candidate Herman Cain, among others — is to impose a national sales tax or value-added tax.

The result, as any tax expert could explain, would shift the national tax burden even further from the wealthy to the working poor and middle class. It is their form of class warfare. And unless the rates were much higher than proposed in Cain’s “9-9-9” plan or Ryan’s original budget, a sales tax would increase deficits and debt instead of reducing them.

Why millionaires like Ryan and Cain favor such schemes is obvious enough. What is far less obvious is why they can still pretend that they revere Reagan — or that they want to cut taxes for anybody except themselves.

Joe Conason is the editor in chief of NationalMemo.com.

© 2011 CREATORS.COM

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.