The Sale That Dropped 600 Points

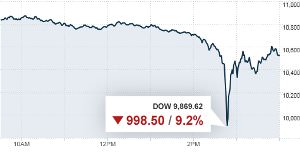

We knew capitalism was crazy, but it turns out it took only a single sale of $4.1 billion in futures to put into motion a series of events that culminated in the “flash crash” of May 6, during which the Dow Jones dropped 600 points in just a matter of minutes.

We knew capitalism was crazy, but it turns out it took only a single sale of $4.1 billion in futures to put into motion a series of events that culminated in the “flash crash” of May 6, during which the Dow Jones dropped 600 points in just a matter of minutes.

The sale, which was discovered after a months-long investigation and long-awaited report from the SEC, concludes that the crash was not a result of market manipulation but rather the regular trading of futures made possible through aggressive deregulation. –JCL

Your support matters…The New York Times:

A single sale of $4.1 billion in futures contracts by a mutual fund touched off a series of events that led to the so-called flash crash, the sharp stock market decline that shook investors and markets on May 6, federal regulators said on Friday.

In a long-awaited report, the Securities and Exchange Commission and the Commodity Futures Trading Commission said they had identified the sequence of events that erased more than 600 points from the Dow Jones industrial average in minutes on the afternoon of May 6 before the markets recovered just as quickly.

Significantly, the report found that the plunge was not caused by any market manipulation but by a single firm trying to hedge its investment position, if in an aggressive and abrupt manner.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.