The Rich Reap the Benefits of a Tax Credit Meant for the Poor

Under Trump’s 2017 tax bill, the wealthy are stealing from those with the least to lose. Jukka Kervinen / Flickr

Jukka Kervinen / Flickr

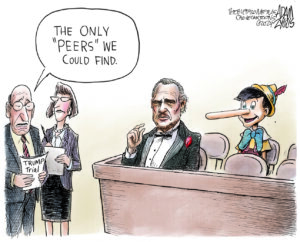

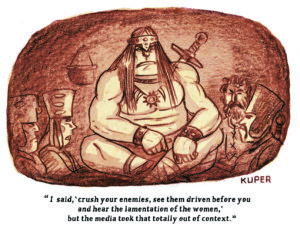

“You all just got a lot richer,” President Donald Trump told guests at his private club, Mar-a-Lago, in 2017 after he signed The Tax Cuts and Jobs Act. The massive tax bill was marketed as an act of financial relief for the middle class. Instead, multiple experts alleged, then and now, it disproportionately benefits the wealthy.

A supposed silver lining of this gift to the rich was an expansion of the Child Tax Credit, a program meant to provide relief for working families.

The 2017 bill increased the maximum credit from $1,000 to $2,000 ($1,400 is refundable for qualifying taxpayers). It was a pet project of Ivanka Trump, the first daughter who, even before her father was elected president, branded herself a champion of women and working families. At least two outlets called it a win for Ivanka. An ABC News headline called it “a quiet political victory.” A Politico article used similar phrasing, saying she “notched a political victory.”

According to a sobering new report from The New York Times, however, “children with the greatest economic needs are least likely to benefit.”

“Food has been a bit of a struggle,” Josh, 16, told The Times. His father, Michael Spielberg, an attendant at Sam’s Club, received only a partial credit, despite a meager salary. Ciera Dismuke, a mother of two expecting a third, who earned $15,000 last year, got just $934. The Times explains that she earned too little to qualify.

Dismuke, Spielberg and their families aren’t alone. Per The Times:

35 percent of children fail to receive the full $2,000 because their parents earn too little, researchers at Columbia University found. A quarter get a partial sum and 10 percent get nothing. Among those excluded from the full credit are half of Latinos, 53 percent of blacks and 70 percent of children with single mothers.

The fawning coverage neglected to mention that in addition to expanding the amount of the tax credit, the bill also expanded who is eligible. Families earning up to $400,000 (originally $110,000) can take advantage of the program. Because the tax credit amount rises with family income, single parents have to make at least $30,000 to obtain the full credit.

According to The Times, “While the 2017 law made millions of upper-income families eligible for the $2,000 credit (in part to offset the loss of other tax benefits), it gave a boost of just $75 to most full-time workers at the minimum wage.”

Anti-poverty advocates and elected officials alike warned this would happen as soon as the law was proposed.

A 2017 Vox article put it bluntly:

If your family looks a bit like Ivanka Trump’s, you might just have a shot at benefiting from the national child care proposal she’s shopping around Congress. But if you’re one of the millions of low- and middle-income parents hoping to catch a break? Don’t count on it.

Earlier this year, Rep. Rosa DeLauro, D-Conn., and Neera Tanden, president of the Center for American Progress, argued against the continuation of the plan in an op-ed for NBC News:

They made families with incomes of as much as $400,000 eligible for a child tax credit of $2,000 per child — including members of Congress themselves. But a single parent with two children working full time at the federal minimum wage will receive an increase of only $75 — or less than $1.50 per week.

DeLauro and Tanden instead argued for the passage of the American Family Act, which would extend the credit to $3,000, and create an additional Young Child Tax Credit of up to $3,600 for children under 6. It also would remove the income thresholds that hurt single-parent families.

Supporters of the original plan argue that the policy is a tax break, not an anti-poverty program, and so shouldn’t necessarily be targeted toward the needy. That the Democrats want to remove the income tests, and instead make the Child Tax Credit eligible for the working and non-working poor alike, The Times observes, reflects “a shift for a party that since the Clinton administration has been wary of the welfare label and reflects concerns over stagnant wages.”

Sen. Michael Bennet, D-Colo., and an advocate for reforming the tax credit, told The Times about the Trump bill, “It left out 26 million kids” from receiving the full, highly touted amount.

He continued, “It’s critical that we don’t leave it as a half measure. Our entire conception of ourselves as a land of opportunity is diminished by the fact that our child poverty rates are as high as they are.”

Read the full New York Times article here.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.