Taxpayers Are Subsidizing Bonuses for Wall Street CEOs

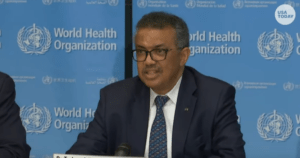

A little-known section of the U.S. tax code “created a legal process by which publicly held companies can lower their tax bills by boosting CEO pay,” reports George Zornick at The Nation. (Pictured: John Stumpf, Wells Fargo chairman and CEO.)

John Stumpf, Wells Fargo chairman and CEO. (Richard Drew / AP)

A little-known section of the U.S. tax code “created a legal process by which publicly held companies can lower their tax bills by boosting CEO pay, leaving taxpayers on the hook for the lavish salaries of corporate titans,” reports George Zornick at The Nation.

Section 162(m) was a well-intentioned effort by Bill Clinton to rein in executive pay by capping tax deductions for CEO salaries at $1 million. There’s a loophole in the language, however, that allows exemptions for stock options or any other pay that is considered “performance-based,” and that loophole has lead to explosive growth in various stock options and bonus payouts for executives—all subsidized by taxpayers. …

Say, for example, you are Wells Fargo chairman John Stumpf. Between 2012 and 2015, you received $155 million in “performance-based” pay above your actual salary, which is already quite generous. You also saved your company a lot of money by getting paid so much—according to a new study by the Institute for Policy Studies, Wells Fargo was able to claim a $54.2 million tax subsidy in those years based solely on Stumpf’s pay.

Stumpf was the biggest beneficiary of this whacky system, but surely not the only one. The CEOs at the top 20 American banks claimed nearly $253 million in taxpayer benefits between 2012 and 2015 for executive bonus and stock options[.]

—Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.